Generally speaking, you need a credit score of 620 to be eligible for a mortgage when buying a home. Even with a credit score as low as 500, you can still purchase a home, but you’ll have to pay a higher interest rate and a bigger down payment. Additionally, your monthly mortgage payment will increase significantly, which will directly impact the price of the home you can qualify for.

You can determine whether it’s time to buy or wait by understanding the minimum credit score needed to purchase a home as well as how your scores affect your rate and payment.

How We Make Money

The businesses whose offers you see on this website pay us. Unless our mortgage, home equity, and other home lending products are specifically prohibited by law, this compensation may have an impact on how and where products appear on this website, including, for example, the order in which they may appear within the listing categories. However, this payment has no bearing on the content we post or the user reviews you see here. We don’t include the range of businesses or loan options that you might have.

Our goal at Bankrate is to assist you in making more informed financial decisions. Although we follow stringent guidelines, this post might mention goods from our partners. Heres an explanation for . Bankrate logo.

Bankrate was established in 1976 and has a long history of assisting consumers in making wise financial decisions. We’ve upheld this reputation for more than 40 years by assisting people in making sense of the financial decision-making process and providing them with confidence regarding their next course of action.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. All of the content we publish is objective, accurate, and reliable because it is written by highly qualified professionals and edited by subject matter experts.

One of the most significant financial decisions a person will ever make is whether to buy or sell a home. Our real estate editors and reporters concentrate on teaching customers how to handle the intricate and dynamic housing market as well as this life-altering transaction. Our mission is to provide you with the assurance that you are making the greatest and most informed real estate decision possible, from the time you find an agent to the time of closing. Bankrate logo.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions.

We value your trust. Our goal is to give readers reliable, unbiased information, and we have established editorial standards to make sure that happens. Our reporters and editors carefully verify the accuracy of the editorial content they produce, making sure you’re reading true information. We keep our editorial staff and advertisers apart with a firewall. No direct payment from our advertisers is given to our editorial staff.

The editorial staff at Bankrate writes for YOU, the reader. Providing you with the best guidance possible to enable you to make wise personal finance decisions is our aim. We adhere to stringent policies to guarantee that advertisers have no influence over our editorial content. Advertisers don’t pay our editorial staff directly, and we carefully fact-check all of our content to guarantee accuracy. Thus, you can be sure that the information you’re reading, whether it’s an article or a review, is reliable and reputable. Bankrate logo.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our professionals have assisted you in managing your finances. We always work to give customers the professional guidance and resources they need to be successful on their financial journey.

Because Bankrate adheres to strict editorial standards, you can rely on our content to be truthful and accurate. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that is unaffected by our sponsors.

By outlining our revenue streams, we are open and honest about how we are able to provide you with high-quality material, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment when you click on specific links that we post on our website or when sponsored goods and services are displayed on it. Therefore, this compensation may affect the placement, order, and style of products within listing categories, with the exception of our mortgage, home equity, and other home lending products, where legal prohibitions apply. The way and location of products on this website can also be affected by other variables, like our own unique website policies and whether or not they are available in your area or within your own credit score range. Although we make an effort to present a variety of offers, Bankrate does not contain details about all financial or credit products or services.

Your credit score may affect the terms and interest rate of your loan in addition to your ability to obtain a mortgage. When determining whether you can realistically afford the home you want, mortgage lenders take into account your credit score in addition to other factors like employment, income, and debt. While certain mortgage programs accept applicants with lower credit scores, a higher score protects you from higher fees, so the higher your score, the lower your mortgage will be overall.

2022 mortgage and credit score statistics Home Equity

- 768 is the median credit score in the U. S. based on data from the Federal Reserve Bank of New York’s Q3 2022 for individuals getting a mortgage.

- A recent report from FannieMae states that the average credit score for first-time homebuyers is 746.

- According to a 2022 Experian report, Minnesota has the highest average credit score in the nation, at 742.

- Mississippians, with an average credit score of 681, have the lowest credit scores nationally.

- According to the most recent State of Credit data from Experian, the average mortgage debt is $229,242.

- With an average mortgage debt of $259,100, Gen X borrowers have the highest mortgage debt.

Credit score to buy a house

| Type of loan | Minimum credit score |

|---|---|

| Conventional | 620 |

| FHA | 580 |

| VA | No requirement, but generally low- to mid-600s |

| USDA | No requirement, but generally 640 |

Some types of mortgages have specific minimum credit score requirements.

A credit score of at least 620 is necessary for a conventional loan, but a score of 740 or higher is preferred as it may enable you to obtain a more enticing interest rate, reduce your down payment, and avoid paying for private mortgage insurance.

A credit score as low as 580 or 500 can qualify for an FHA loan, depending on the size of the down payment. Despite this, it can still be difficult to obtain an FHA loan with a very low credit score because lenders have the ability to set their own higher credit requirements.

The U. S. The Department of Veterans Affairs (VA) does not establish minimum credit scores for VA loans; however, numerous VA lenders do have specific credit requirements, usually falling between the low and mid-600s. Likewise, USDA loans are exempt from U.S. government credit score requirements. S. Department of Agriculture requirements, but you should still be ready to fulfill the minimal requirements set by lenders, which are typically 640

Credit scores and mortgage rates

In general, a higher credit score translates into a lower mortgage rate, which means you’ll pay less each month and in interest overall. A $286,400 30-year fixed-rate mortgage could cost you the following, depending on your credit:

| Credit score | APR | Monthly mortgage payment | Interest total |

|---|---|---|---|

| 760-850 | 6.229% | $1,760 | $347,022 |

| 700-759 | 6.451% | $1,801 | $361,968 |

| 680-699 | 6.6628% | $1,834 | $373,991 |

| 660-679 | 6.842% | $1,875 | $388,648 |

| 640-659 | 7.272% | $1,958 | $418,490 |

| 620-639 | 7.818% | $2,065 | $457,100 |

Average mortgage debt by age group

Americans usually start taking out loans when they are young adults and must pay for large expenses like housing and schooling while earning less money. As their incomes increase in middle age, they typically borrow less money. Americans begin to deleverage as they get older and pay off their debt.

| Generation | Average credit score | Average mortgage debt |

|---|---|---|

| Silent generation | 729 | $163,254 |

| Baby boomers | 724 | $198,203 |

| Generation X | 685 | $259,100 |

| Millennials | 667 | $255,527 |

| Generation Z | 660 | $192,276 |

Average credit score by state

The credit health of Americans varies across states. Based on Experian data, the state of Minnesota has the highest average credit score (742), followed by Vermont (736) and Wisconsin (735). Mississippi (681) and Louisiana (689) have the lowest average scores.

Other factors in mortgage preapproval

In addition to your credit score and history, mortgage lenders consider your:

- Employment history and income: It is important for lenders to see that you have a steady source of income and supporting documentation. It’s advantageous to have worked for the same company for two or more years, and be ready to submit your last two years’ tax returns.

- Down payment: A higher down payment can improve your chances of being accepted and get a better interest rate, but watch out that it shouldn’t deplete your emergency funds.

- Debt-to-income ratio: A lender’s assessment of an affordable monthly mortgage payment is based in part on your debt-to-income (DTI) ratio. Having a high debt-to-income ratio may restrict your options even if your credit is good and your income is steady.

- Assets: If you have a large amount of savings and other assets, such as retirement or investment accounts, you may be a more desirable borrower overall.

- Raising your credit score will enable you to get a better mortgage rate. If there are any past due accounts, start by bringing them current. Then, going forward, make sure to make your payments on time. Reduce your credit card debt as much as you can. If you have debts from multiple sources, you may want to think about taking out a debt consolidation loan, which combines all of your payments into a single, monthly installment. Avoiding applying for new credit and keeping open previous accounts are two more strategies to raise your credit score.

- What credit score is required to purchase a home? Generally speaking, a higher score is preferred. At the lower end of the spectrum, purchasers with a credit score of 500 might be qualified for an FHA loan with a 10% down payment; a score of 580 would only require 3% 5 percent down. However, you would also need to pay for private mortgage insurance. You may be eligible for a VA loan or a conventional loan if you can raise your score to 620.

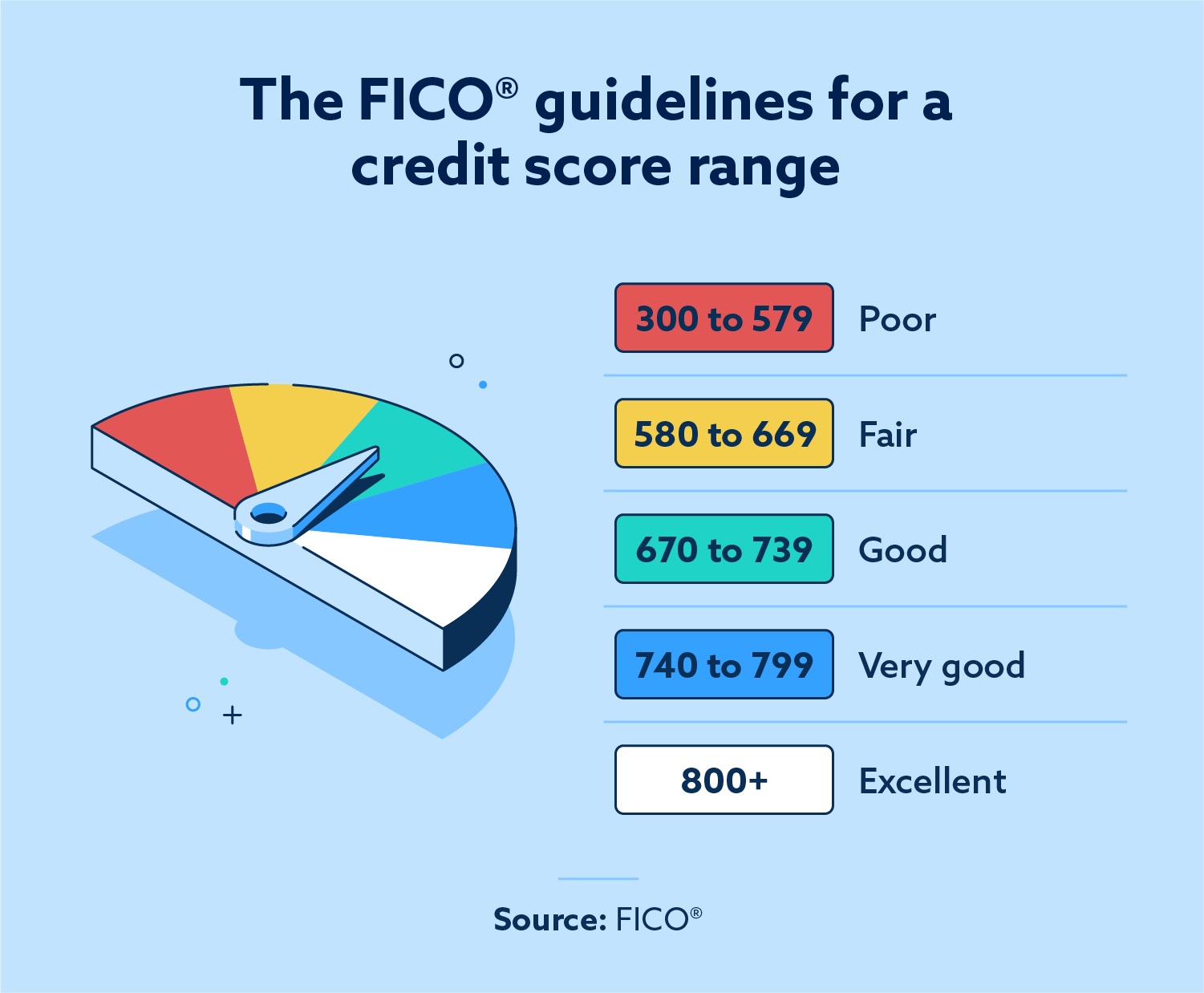

- The greater the FICO score, which goes from 300 to 850, the better. Any score over 670 is regarded as “good,” but those between 740 and 799 are excellent, and those above 800 are remarkable.

- It depends on the lender and loan program. Although there are no minimum credit score requirements for USDA and VA loans, the majority of lenders require a minimum credit score of 640 or 620, respectively. You’ll probably need great credit to be eligible for a no-down-payment mortgage from a commercial or private lender.

FAQ

What is an OK credit score to buy a house?

Some types of mortgages have specific minimum credit score requirements. A credit score of at least 620 is necessary for a conventional loan, but a score of 740 or higher is preferred as it may enable you to obtain a more enticing interest rate, reduce your down payment, and avoid paying for private mortgage insurance.

Is a 720 credit score good enough to buy a house?

Home loans A credit score of 720 is probably high enough, provided you have sufficient income, to assist you in obtaining a government-backed mortgage, such as an FHA or VA loan. It’s probably not high enough, though, to obtain the best interest rates out there.

What credit score do I need to buy a $250000 house?

A credit score of at least 620 is required to be eligible for a conventional loan, however some lenders may only accept applications for conventional mortgages from borrowers with credit scores of 680 and higher.

Is a 600 credit score good enough to buy a house?

Yes, 600 can theoretically be a good enough credit score to buy a house because some home loan options are specifically made for borrowers with less-than-perfect credit. On the other hand, there can be some obstacles in your way of becoming a homeowner, like higher interest rates and extra expenses.

Read More :

https://www.bankrate.com/real-estate/average-credit-score-to-buy-a-house/

https://www.quickenloans.com/learn/credit-score-to-buy-a-house