A closed account can be removed from your credit report in a few different ways, but doing so may have an impact on your credit score.

It is likely common knowledge that each time you pay off a debt or credit card, your credit report is updated and your credit score is affected. However, you might not be aware that your credit report may still show your borrowing history even after you pay off a loan or close a credit account.

This implies that the closed account may continue to have an impact on your score for a long time, either positively or negatively. The good news is that the closed account might be expunged from your credit report.

Bruce McClary, senior vice president of membership and communications at the National Foundation for Credit Counseling, states that “anyone can issue a request to have a closed account removed permanently from their credit files.”

Unfortunately, your request is not guaranteed to be granted. The following information will help you delete closed accounts from your credit report.

These are the three main ways to remove closed accounts from your credit report: dispute any inaccuracies, send a goodwill letter requesting removal or wait for the closed accounts to be removed after enough time has passed.

There are three primary methods for removing closed accounts from your credit report: (1) contesting any errors, (2) submitting a formal goodwill letter asking for removal, or (3) just waiting for the closed accounts to be deleted gradually. Having said that, closing accounts can lower your credit score, so before acting, carefully assess your circumstances.

Although it’s not always possible, you can try to have a closed account removed from your credit report. Nevertheless, closing accounts isn’t always a good idea, and in certain situations, it might even lower your credit score.

If any closed accounts contain false negative information, you should generally attempt to delete them; however, you probably shouldn’t touch any accounts that are positively impacting your credit history.

We’ll discuss whether it’s a good idea to try to have closed accounts removed from your credit report, how doing so might impact your credit score, and how to do so below.

How to remove closed accounts from your credit report

As previously discussed, you can try to have closed accounts removed from your credit report by contacting the credit bureaus to dispute inaccurate information, requesting removal in writing with a formal “goodwill letter,” or just waiting for the account to be removed.

Continue reading to find out more about when to use each of these strategies to remove a closed account from your credit report.

Dispute inaccurate information

You have the option to contest information found in a closed account that appears on your credit report if it is erroneous and possibly have the item removed.

How to dispute inaccurate information:

- Write a letter to each of the three major credit bureaus (TransUnion, Experian, and Equifax) outlining the information you would like removed, why you think it is inaccurate, and what information you are challenging.

- In a similar vein, write a letter to the financial institution that gave the bureaus the information.

- After a month or more has gone, wait for responses before reviewing your updated report and score.

To assist you along the way, we have a guide that outlines the dispute procedure.

Write a goodwill letter

A formal request to a creditor to have a negative item removed is known as a goodwill letter.

Creditors might be willing to remove negative items upon request, even though they are not obligated to, especially if you have a long history with them or if there were unique circumstances that resulted in the negative item.

But generally speaking, goodwill letters are more helpful for missed or late payments than for larger negative items like repossessions and collection accounts.

Apart from goodwill letters, you can also use a pay for delete letter to ask for the removal of an account. These letters may result in a deal whereby a collection agency agrees to cancel an account in exchange for either a full or partial payment. However, the original account that was sent to collections may still be listed on your report if the collection agency chooses not to delete it.

Wait for the closed account to be removed over time

You could wait for a closed account to go away on its own since nothing stays on your report permanently. Credit reports can contain information about closed accounts as well as other items for up to ten years.

Therefore, if you’re concerned that a closed account that is more than a few years old and contains bad information that could affect your credit score, know that it will eventually disappear from your credit report. After enough years have passed, positive information about closed accounts also disappears from your report, so it’s critical to maintain excellent credit practices with a range of account kinds.

Should you remove closed accounts from your credit report?

If there are any closed accounts with negative items that can be removed or inaccurate information, you should try to remove them. Otherwise, closing accounts usually doesn’t need to be removed from your credit report. While outdated accounts that demonstrate responsible credit usage may be boosting your score, inaccurate information may be harming it and should be corrected.

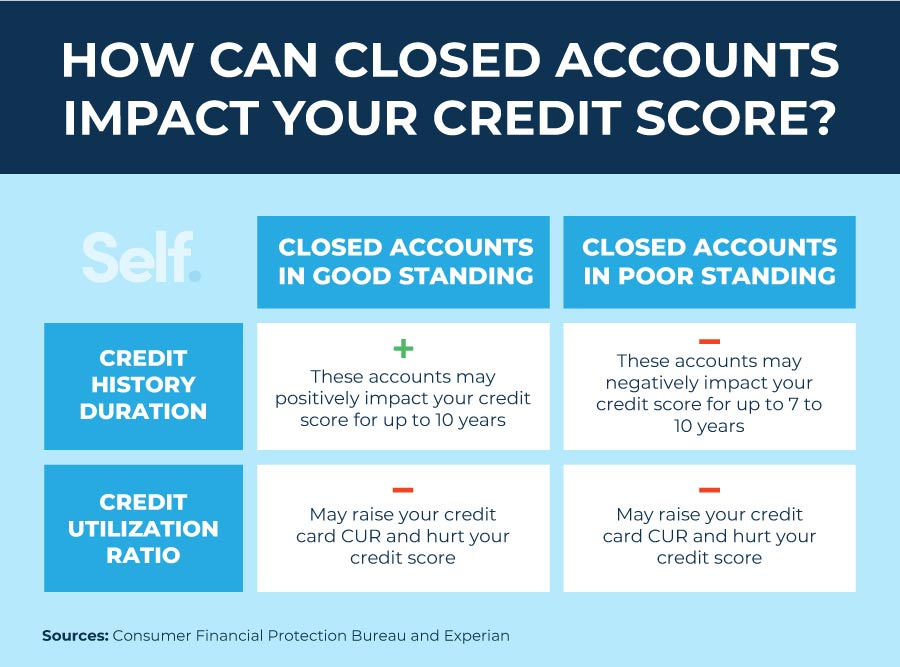

Information about your balances and payment history is retained on your credit report for a considerable amount of time even after you close an account, such as a credit card or personal loan. While accounts with negative marks, such as collection accounts, may stay on your credit report for up to seven years, closed accounts in good standing may be removed from your record after up to ten years.

In the end, knowing what influences your credit ultimately determines whether or not you should attempt to have a closed account removed.

Five primary factors are used to calculate your FICO credit score:

- Payment history (35 percent)

- Credit utilization (30 percent)

- Length of credit history (15 percent)

- Different types of credit (10 percent)

- New credit applications (10 percent)

Since both open and closed accounts are included in credit reports, the removal of a closed account from your record may have an impact on certain credit factors. For instance, your length of credit history may decrease if you made payments on a personal loan for a number of years and that account is no longer on your report. This could have a negative impact on your credit.

Although removing a closed account from your report won’t necessarily lower your score, it’s usually a good idea to keep open accounts there as they may have a positive overall effect.

Working to have closed accounts removed is part of a good credit repair strategy, though, as it can lower your score if they have negative items that can be removed and inaccurate information.

Removing closed accounts from your credit report: FAQ

If you’re still not sure how to get a closed account removed from your credit report, here are some frequently asked questions and their responses.

When to remove a closed account from your credit report

Closed accounts with false or unfavorable information should be removed, but accounts that are improving your credit history should be kept open. Accounts with inaccurate information could lower your credit score.

How long does a closed account stay on my credit report?

Depending on the circumstances surrounding the account, closed accounts may remain on your credit report for seven to ten years.

Why is a closed account still on my credit report?

Unless you take action to try and get the closed accounts removed sooner, such as sending goodwill letters or disputing false or unfair information, all closed accounts remain on your credit report for many years, depending on their positive or negative history.

If there are closed accounts with false negative items on your credit report, the staff at Lexington Law Firm can help you with credit repair. Our staff could help you take significant steps toward enhancing your credit by reviewing your credit report and supporting you with disputes.

Note: The listed attorney has not written the articles; they have only reviewed them. The information on this website is only for general informational purposes and is not meant to be used as legal, financial, or credit advice. The reader, user, or browser does not establish an attorney-client or fiduciary relationship with the owner of the website, authors, reviewers, contributors, contributing firms, or their respective agents or employers by using this website or any of the links or resources it contains.

Candace Begody worked at Lexington Law as an associate attorney. Ms. Begody was born and raised in Arizona. She received a master’s in business from the Wharton School of Business and a juris doctor from Arizona State University’s Sandra Day OConnor College of Law. P. Carey School of Business, also at ASU. Ms. Begody joined Lexington Law in 2022. She practiced transactional and business law in the Phoenix region before that. Ms. Begody was based in the Phoenix office and has an Arizona law license. Related Articles.

FAQ

Can closed accounts be removed from credit report?

Wait for the closed account to be removed over time. Since nothing remains on your report indefinitely, you can wait for a closed account to disappear on its own. Credit reports can contain information about closed accounts as well as other items for up to ten years.

How long does it take for accounts to be removed from credit report?

Generally speaking, negative information remains on credit reports for seven years.

What is the 609 loophole?

You are entitled to the following information under section 609: All of the data in your consumer credit files The source of that information. Every organization that has viewed your credit report in the last two years (apart from those used to wrap up an inquiry) Companies that have sent soft inquiries in the last year

Read More :

https://money.usnews.com/credit-cards/articles/how-to-remove-a-closed-account-from-your-credit-report