What Is a Credit Card Balance?

The amount you charge when using a credit card is added to the total amount you owe, which is known as your credit card balance. Not only is the total of your purchases included in your balance, but It also includes any fees and penalties the card issuer has assessed you, along with the interest you owe on the balance. These could include late payment penalties, cash advance fees, annual fees, and many more, which we’ll go over later.

The card issuer will notify you of your balance at the conclusion of each monthly billing cycle, along with the minimum payment amount and due date. You can maintain good standing with your credit issuer by paying the minimum amount due on time. The remaining amount then carries over into the balance for the following month and is charged interest. Because of this, it’s advisable to pay more than the minimum and, ideally, settle your debt in full each month. Nevertheless, you are unable to use one credit card to settle the balance on another.

Your credit score won’t be impacted if you pay the minimum amount due each month and roll it over to the following one. However, there may be an issue if your balance is excessively high in comparison to your credit limit. When assessing your credit utilization ratio, potential lenders determine how risky it might be to lend you money. A person who frequently uses their credit card to the limit will come across as less financially responsible than someone who maintains a sizeable amount of credit available for emergencies.

Another important component in figuring out your credit score is your credit utilization ratio. When you have a credit limit of $5,000 on your credit card, for instance, you should try to avoid letting your balance go over $1,500. A good ratio is typically 3% volume or less.

How Credit Card Interest Rates Work

The annual percentage rate, or APR, is how your credit card issuer calculates the interest that you pay. The APR is applied to your outstanding balance each month and is divided by 12 because it is an annualized percentage. For instance, a credit card with a 2020 percent annual percentage rate will cost you approximately 2021 67% interest on your outstanding balance each month.

(A standard revolving credit card, which lets you roll over your balance between billing cycles, is used in this example.) Another kind of card that functions similarly to a credit card but needs you to pay off the entire amount each month is called a charge card. ).

APRs can vary depending on the card; for example, some cards have separate rates for purchases and cash advances. All of that is detailed in the terms of your credit card, which you ought to receive when you first open an account. When looking for a credit card, you can typically find the terms of the card online.

Numerous fees and penalties associated with credit cards can be avoided. However, if you don’t exercise caution, they may wind up accounting for a sizable portion of your monthly payments.

Understanding (and Avoiding) Credit Card Fees

There is typically a lot of fine print attached to credit cards concerning fees, penalties, and other charges that may accrue—sometimes unintentionally. Some important ones to know about:

Late fees. You might be assessed a late fee if you fail to make your minimum payment by the deadline. For the first late payment, the cost can reach $28, and for subsequent late payments, it can reach nearly $39 in total. Furthermore, your credit score may suffer as a result of the credit bureaus reporting your late payments and having a record of them in your credit history.

Over-limit fees. Your credit card issuer may impose an over-limit fee on you in the event that you use your card beyond its credit limit. The amount of this fee varies from $25 to $35 based on how frequently you exceed your limit. Be aware that when you try to make a purchase, some card issuers will just decline any charges that are higher than your credit limit.

Annual fees. This is the annual charge you make just to keep the card. There are plenty of credit cards that don’t charge annual fees, but some that do might have reward programs that give you more points for your purchases.

Cash advance fees. Some credit cards allow you to take out cash advances. This fee can be expensive and is typically computed as a percentage of the money you receive.

Returned payment fees. If your credit card payment bounces for any reason, including insufficient funds, you will be responsible for this fee.

The Bottom Line

Although credit cards are a useful tool for establishing a positive credit history, it’s crucial to avoid taking on more than you can handle and getting deeply in debt. It’s still preferable to make the required minimum payment each month than to forget to make one. However, the more of your credit card debt you are able to pay off, the lower your interest costs will be. If you can manage it, paying off your entire balance each month will give you access to a credit card’s other advantages and convenience at the lowest possible cost. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

How does a monthly payment on a credit card work?

The monthly statement balance is typically used to determine the minimum credit card payment. The minimum payment may consist of late fees and additional interest in addition to a portion of the outstanding amount. Alternatively, it might be a fixed percentage of the total amount. Furthermore, past-due sums may occasionally be included in the minimum payment.

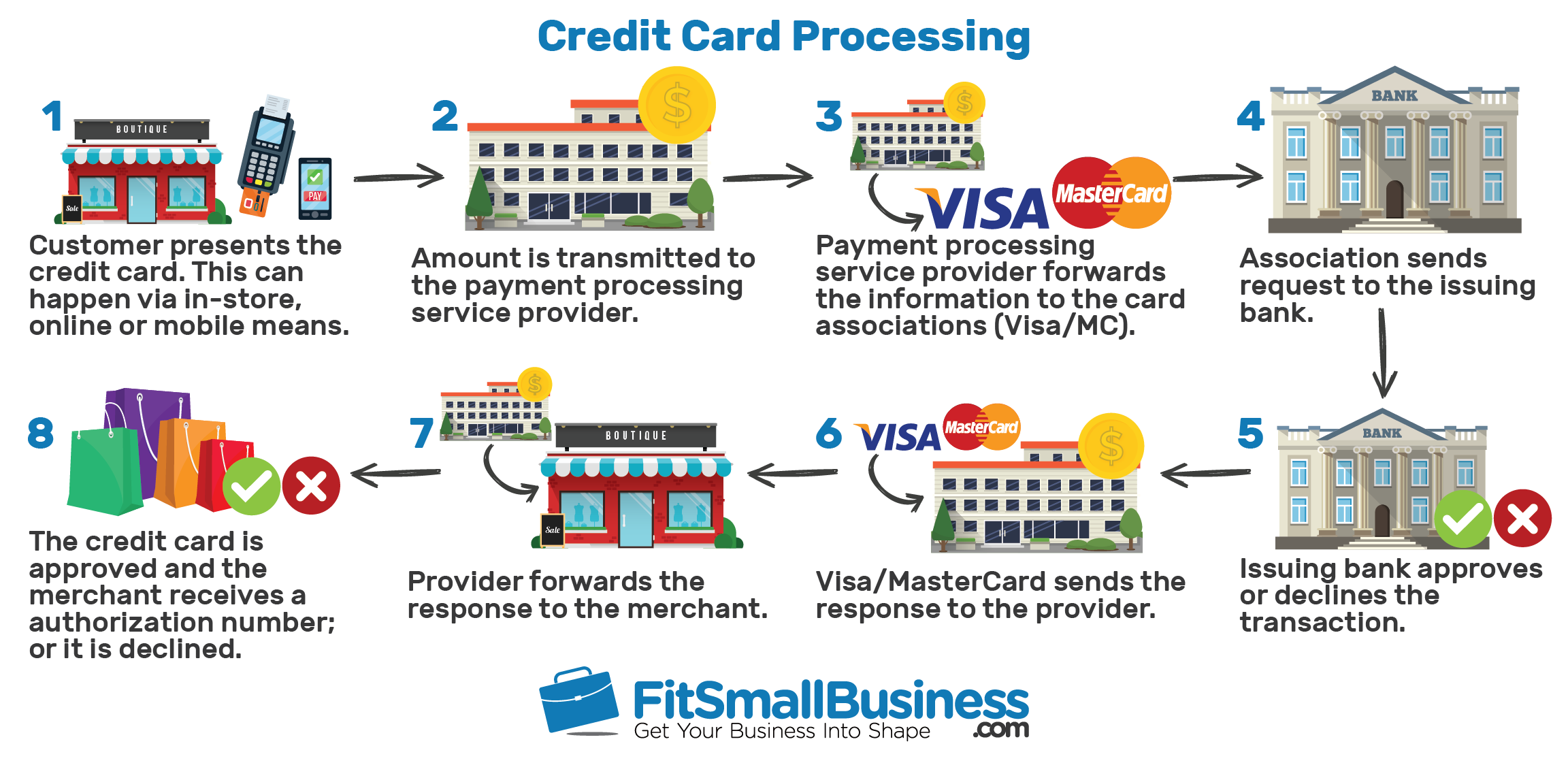

How does credit card payment method work?

Step-by-step instructions for the credit transaction are as follows: You swipe, insert, or tap your credit card, or your mobile device if you’ve linked it to an electronic wallet. The acquiring bank receives your account information from the card reader. The acquiring bank obtains authorization from your card issuer via a payment network.

Do I pay my credit card in full every month?

You can prevent interest charges by paying off your credit card debt in full by the due date each month. Your credit card’s current balance represents the most recent estimate of your debt.

How does credit card payment cycle works?

Usually, your credit card billing cycle lasts between 28 and 31 days. Although the length of each billing cycle is flexible, it should generally be one month. Even if the December billing cycle ends in January, your credit card should still have 12 billing cycles annually.

Read More :

https://www.investopedia.com/how-do-credit-card-payments-work-5069924

https://www.capitalone.com/learn-grow/money-management/how-credit-cards-work/