You could be earning significant cashback when paying bills with your credit card. But not all bills are created equal.

Monthly bills seem to be growing every year. Once a single cable package has given way to two phone bills, three streaming services, and internet from various providers. That disregards the cost of daily necessities like electricity, heat, water, and more. However, what if there was a way to get compensated for paying your bills on time?

With every purchase, certain financial institutions provide reward cards that allow you to receive a percentage back. Spending can feel great, so you might be wondering if using credit cards to pay for bills is a good idea.

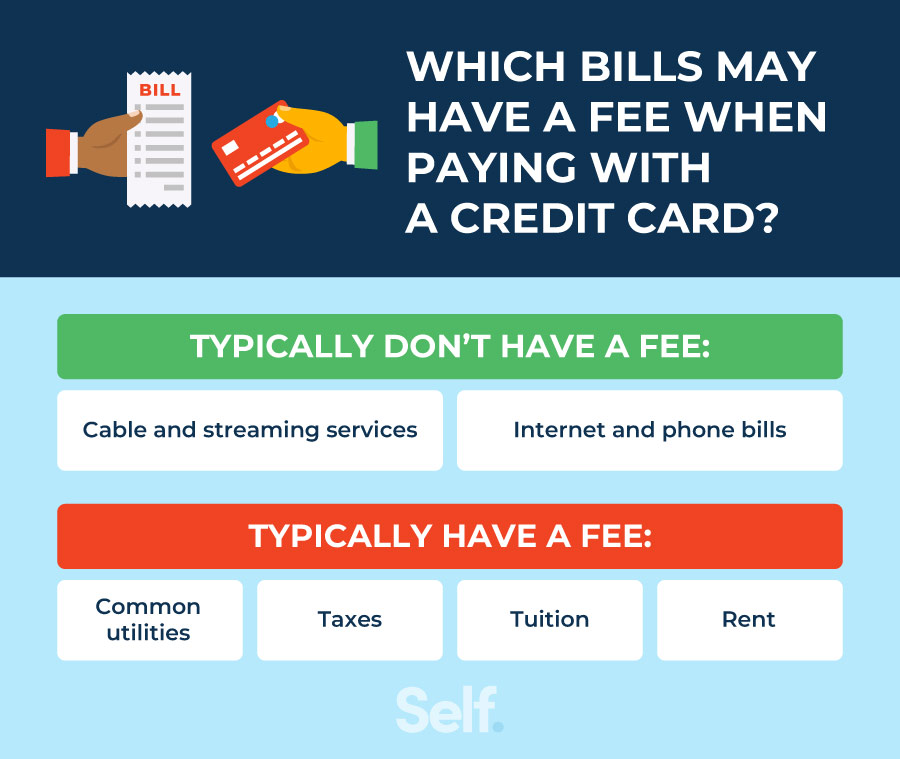

In summary, you can typically use a credit card to pay for entertainment and non-essential items without incurring any fees. Frequently, credit cards can be used to pay for services, utilities, and taxes, but there may be a processing fee. Loan payments are usually check or bank withdrawal payments only.

Setting up Autopay for Cable, Phone, and Internet Bills

Most internet, phone, and cable companies will take a credit card for payment. Using your credit card to set up monthly autopay for your bills in order to prevent late fees

Can you Pay for Streaming Services with a Credit Card?

Yes. 95% of streaming services accept credit cards as payment. Don’t risk canceling a streaming service because you’re afraid of missing out, even if you don’t use it often. Paying for streaming services will get you cashback rewards.

Can You Pay Your Utility Bills with a Credit Card?

It’s debatable if your home utility provider accepts credit cards as payment for bills. The best course of action is to presume that they accept credit cards, albeit at a convenience and processing fee.

Looking to Pay your Rent or Mortgage with your Credit Card?

You’ll need to pay other bills in order to raise your credit score, even though paying your rent or mortgage would be a surefire way to do so. It is quite improbable that your landlord or lender would take credit cards as payment. There are third-party options available if you feel compelled to use a credit card to pay off your mortgage or rent.

These businesses will cut a check to your mortgage lender or landlord if you give them the equivalent of your rent or mortgage plus a processing fee. Check the percentage before using a credit card to pay for your house or apartment because these processing fees have the potential to significantly increase your bill.

Paying off your Car Loan with a Credit Card

It is uncommon for loans and mortgages to be able to be paid off with credit cards. If they can, they charge a significant processing fee. This cost will be significantly higher than any cashback you receive.

Doing Your Taxes with a Credit Card

You probably already know that you can use your credit card to pay for some taxes if you’ve completed your taxes, which if you’re reading this article, you should have done at least once. But, once again, processing fees apply.

This is only a short summary of the typical invoices and services that we typically pay for each year. If you pay your bills on time each month and you want to increase your cashback and credit score, you should think about applying for a cashback credit card like our Visa Signature Empower Card. How Can We Help?.

Chat is unavailable at this time. We can be reached by email at ithrive@firstcomcu at any time, or by phone from 8 a.m. to 8 p.m. on Monday through Friday and from 9 a.m. to 3 p.m. on Saturday. org. This website uses cookies.

We use technical, analytical, marketing and preference cookies. They allow our site to function properly and provide us with data about how our site is used. By browsing this site, you accept their use. Read our privacy policy for more details.

FAQ

Can I pay any bill with a credit card?

Bill payment with a credit card may be possible, depending on the merchant and the nature of the bill. Usually, credit cards cannot be used to pay for rent, mortgages, or auto loans. When using a credit card to pay certain bills, such as utility bills, you might be charged a convenience fee.

What bills can you pay with a credit card with no fee?

bills for which there are usually no convenience fees when paying with a credit card Cable and streaming services: Since these services don’t usually have extra costs, credit cards are the best way to pay for them. Plus, it’s simple to never forget a payment when you set up automatic bill pay.

Is it smart to use credit card for bills?

Generally speaking, if you can follow these two guidelines, using a credit card to pay your monthly bills can be a smart idea. Every month, make sure to pay off the entire balance on your statement on time. If you can’t afford to pay your bills with cash, stay away from charging them to your credit card.

Read More :

https://www.firstcomcu.org/post/a_guide_to_bills_you_can_and_cant_pay_with_a_credit_card.html

https://www.53.com/content/fifth-third/en/financial-insights/personal/credit-cards/5-monthly-expenses-to-put-on-your-credit-card.html