Credit cards can be useful tools. But they have their limits when it comes to spending. Specifically, credit limits.

This post will explain how credit limits are established, how they are used, and what happens if you use your credit limit more than it is allowed.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our professionals have assisted you in managing your finances. We always work to give customers the professional guidance and resources they need to be successful on their financial journey.

Because Bankrate adheres to strict editorial standards, you can rely on our content to be truthful and accurate. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that is unaffected by our sponsors.

By outlining our revenue streams, we are open and honest about how we are able to provide you with high-quality material, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment when you click on specific links that we post on our website or when sponsored goods and services are displayed on it. Therefore, this compensation may affect the placement, order, and style of products within listing categories, with the exception of our mortgage, home equity, and other home lending products, where legal prohibitions apply. The way and location of products on this website can also be affected by other variables, like our own unique website policies and whether or not they are available in your area or within your own credit score range. Although we make an effort to present a variety of offers, Bankrate does not contain details about all financial or credit products or services.

The issuer of the new credit card will choose a credit limit for your account after it has been approved. While some issuers set credit limits that apply to all new cardholders, many use data from your credit report to determine your credit limit.

Since they are seen as less of a potential credit risk, people with higher incomes and credit scores are more likely to receive higher credit limits. After all, being able to pay off your debts and having a history of on-time payments are linked to having a high credit score.

If you’re curious about how credit limits operate, how credit card companies determine credit limits, and how to swiftly raise your credit limit, read on.

What is a credit card limit?

The maximum amount that can be charged to a credit card is known as its credit card limit. For example, if the credit limit on your card is $5,000, you can charge up to $5,000 toward the balance. Your credit card limit applies to all transactions that use your line of credit, including cash advances, as well as new purchases and balance transfers. Your whole credit limit is debited even for your annual fee.

Experian estimates that the average credit card limit for Americans in 2021 will be approximately $30,233. This figure does not reflect the per-card limit but rather the total credit available to Americans across all of their credit card accounts. While many credit cards for those with poor credit offer lower credit limits in exchange for the chance to improve your credit score, credit limits typically range from $2,000 to $10,000 per card.

How is your credit limit determined?

Your credit limit is calculated in one of three ways. In some cases, you’re offered a predetermined credit limit. In other situations, your credit score and credit history determine your credit limit. Occasionally, a credit card issuer will conduct a more thorough investigation of your credit history, taking into account any factors that could make you a risky borrower and figuring out the credit limits you currently have on your other cards.

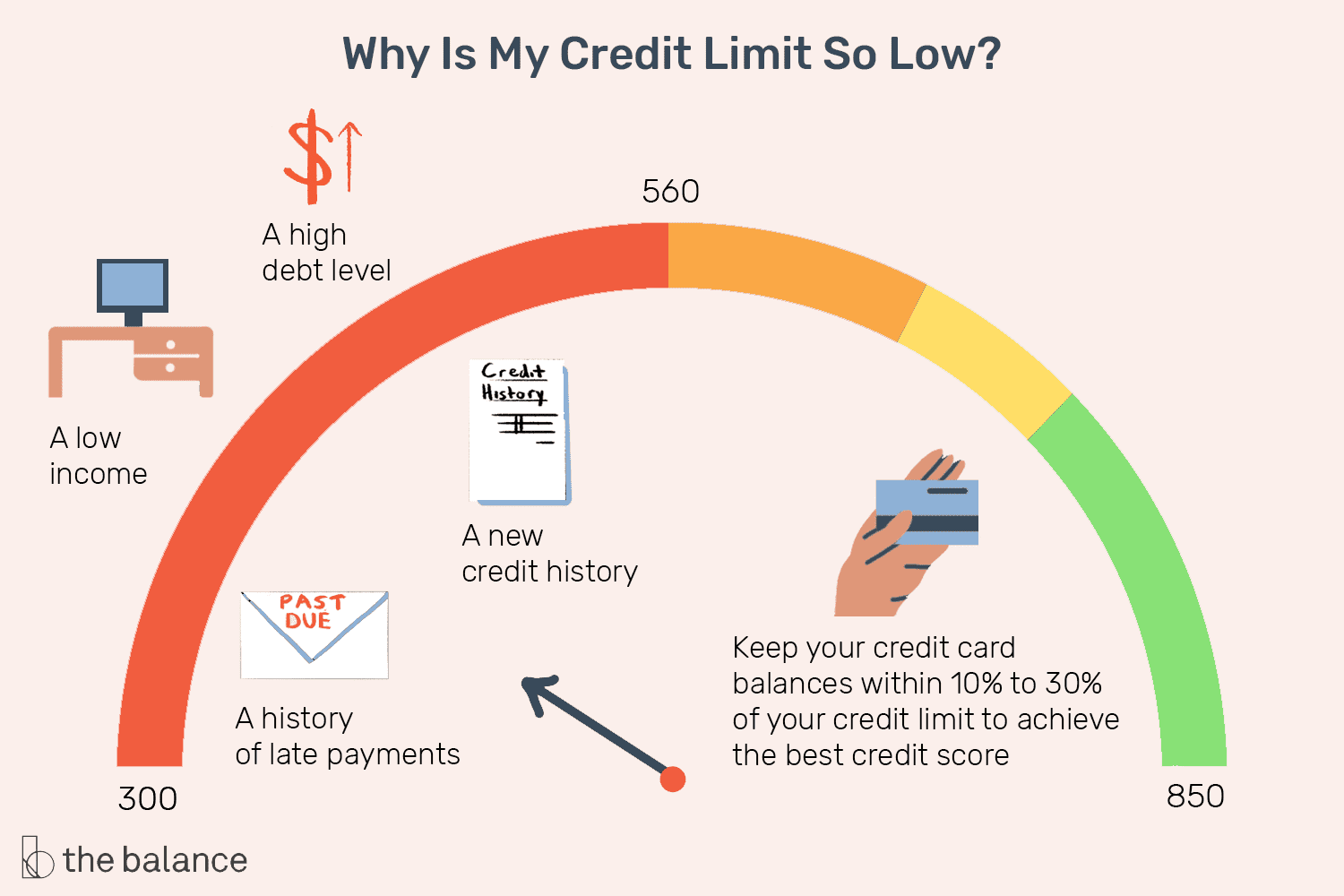

When determining the limit on your credit card, many credit card companies look at your credit score. This implies that your new card limit will depend on a number of variables, including your payment history, credit utilization, credit mix, length of credit history, and recent inquiries. Issuers will probably also take into account your monthly expenses, job, and household income.

The method is comparable to how credit card issuers determine your interest rate, according to Bill McCracken, the former president of Phoenix Synergistics, a MarketTech company. If a particular credit card offer has a $1,000 to $5,000 credit limit range, people with higher credit scores will be awarded the $5,000 credit limit, while people with lower credit scores will be awarded $1,000.

The predetermined credit limit

Certain credit card issuers provide cards with fixed credit limits. For example, a premium credit card would have a $5,000 limit, whereas a starter credit card might have a $500 limit.

“It’s not a very customized choice,” said Eric Lindeen, a former CRM Northwest Inc. senior marketing consultant. “If the limit appears unusually high or low, it has nothing to do with you as a customer. You just applied for the wrong card. ”.

Lindeen recommended contacting the credit card issuer to request a higher credit limit if you are unhappy with the pre-established credit limit on your card. He clarifies that while some issuers give some leeway, they don’t anticipate an increase of more than 10 to 20 percent.

The customized credit limit

Some credit card companies generate a unique credit limit for every new applicant based on a number of factors. This enables credit issuers to reduce risk when extending new credit lines.

To determine a credit limit, some issuers, according to Lindeen, develop a grid system and compare multiple scores, including a credit score and a bankruptcy score. Others base their credit limit on your income or debt-to-income ratio. Some issuers might even consider the credit limit on your other cards, which are listed on your credit reports, according to nationally known credit expert John Ulzheimer, who was previously employed by Equifax and FICO.

What happens if you try to spend over your credit limit?

Thinking about spending over your credit card limit? Think again. Usually, if you attempt to spend more than your credit limit, the transaction will be refused. Prior to the widespread adoption of this policy, some credit card issuers permitted over-limit transactions in exchange for hefty over-limit fees.

It’s crucial to remember that your credit score will suffer the closer your balance is to your credit limit. Your FICO credit score is based on the amount of available credit you are currently using, which means that maxing out your credit cards can have a detrimental impact on your score.

How to increase your credit limit

Increasing your credit limit provides a lot of advantages. You not only gain greater purchasing power but also have the chance to improve your credit score by lowering your credit utilization ratio and raising your available credit.

Furthermore, having higher credit limits on your current credit cards may increase the credit limits you receive on future card offers because some lenders base their credit limit calculations on your current credit card limits.

There are two ways to increase your credit limit. You have two options: either you ask for a higher credit limit on your own, or you wait for your credit card issuer to offer it to you.

Let’s look at both options in detail:

Wait for your credit card issuer to offer a higher credit limit

Your credit card issuer might give you a higher credit limit if you maintain excellent credit practices. Ulzheimer stated, “Once you’ve had the card for a while, issuers are likely to adjust your limits based on your usage patterns.”

Depending on how you’ve been using your credit cards, these changes could result in a decrease or an increase in your credit limit. In order to assess a cardholder’s present credit behavior and potential credit risk, credit card issuers thoroughly examine accounts and obtain credit reports. Issuers might carry out this every year, or a cardholder’s late payment might initiate a review, according to McCracken.

Request a higher credit limit

You can always ask for a higher credit limit yourself if you’d rather not wait for your credit card issuer to grant you one. You can ask for credit limit increases from a lot of credit card issuers via your online account or their mobile app. If not, customers can request an increase by calling their issuers directly.

Make sure your credit card issuer is aware of any recent changes to your financial circumstances that could influence their decision when you ask for a higher credit limit. Examples of these changes include an increase in your annual income or a recent improvement in your credit score.

Your credit card issuer is probably going to give you the increase as a “good-faith gesture” if you have a history of making on-time payments and having low balances, according to Lindeen. However, if you’ve been behind on your payments, don’t even bother calling, and if your current credit limit is reached, don’t ask for a higher one.

How is your credit limit calculated? Certain credit card issuers provide all applicants with predetermined credit limits. Other credit providers base your credit limit on a number of variables, such as your credit score and credit history.

How can I raise my credit limit? Usually, you can do this by contacting the customer service department of your credit card company by phone or by completing an online form. Another option is to wait for your issuer to extend you a higher credit limit while you maintain excellent credit practices.

See Bankrate’s list of the top high-limit credit cards if you’re looking for a card with a high credit limit from the outset.

FAQ

What is a normal credit limit?

This could affect the products we write about as well as where and how they show up on a page. However, this does not influence our evaluations. Experian reports the average credit card limit was $28,929. 80 in 2022. However, depending on variables like age, income, and credit score, credit card limits can differ significantly.

Is a $1,000 credit limit good?

As $1,000 is significantly higher than the lowest available credit limit while remaining significantly lower than the highest, it’s a good choice if your credit is fair to good. The average credit card limit overall is around $13,000. To obtain a limit that high, you usually need a high income, good or excellent credit, and little to no outstanding debt.

What does a $1500 credit limit mean?

The maximum amount a credit cardholder can use for purchases, balance transfers, cash advances, fees, and interest charges combined is known as their credit limit. Despite having a separate credit limit, credit card cash advances are a part of the total credit limit.

What is the meaning of credit limit?

The maximum amount you can charge on a revolving credit account, like a credit card or line of credit, is known as the credit limit. Every purchase you make with your card adds to your balance and deducts from your credit limit. What’s left over is referred to as your available credit.

Read More :

https://bettermoneyhabits.bankofamerica.com/en/credit/understanding-your-credit-limit

https://www.bankrate.com/finance/credit-cards/how-issuers-determine-credit-card-limits/