We used Planergy to save over $1 million on our spending in the first year, and we recently discovered a way to use it to save roughly $10,000 a month on recurring expenses.

When to issue a credit note

There are two types of credit notes:

Consequently, this implies that a business can issue and receive credit notes. For small business owners, both types are common.

There are various circumstances where issuing a credit note is appropriate. Here are some typical situations in which a credit note should be issued:

- To correct any invoice mistakes (e. g. inflated invoice amount, incorrect discount applied to the invoice)

- To cancel any awaiting payments on an invoice

- to give a refund in the event that the products break down during the guarantee

- If a supplier sends you items that need to be returned, g. because of flaws, damage, or just because they don’t fit the buyer’s requirements)

In these situations, a credit note may be issued to cancel the original invoice, and a corrected invoice may then be issued. You can request a refund of your payment or apply the specified amount to future purchases if you plan to purchase more from that supplier.

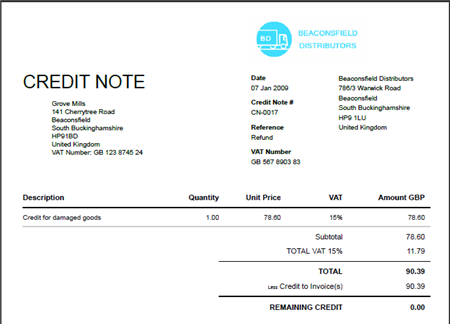

Credit note example

Issuing a credit note for an invoice is a simple process. Credit notes should normally be retained by the issuing company and sent to the customer for whom they are issued.

A credit note may be used in the following way:

- Company A purchases £65 of products from Company Z. Company A gets in touch with Z to let them know that the invoice contains a mistake.

- In order to cancel the original invoice and record the stated amount (£65) as positive under accounts payable, Company Z issues a credit note on the invoice and sends it to A.

- Company Z may request a refund or apply the £65 mentioned in the credit note toward future orders if Company A has already paid Company Z. The credit note cancels what is owed and balances Company Z’s books if A has not yet paid Z.

Credit notes in accounting

Credit notes used to be recorded as credits in the sales book for that specific customer, crediting their account with the agreed upon amount.

The credit note would be recorded as a debit under revenues and a credit under accounts receivable in double-entry bookkeeping systems. Every credit note must be documented and updated in the relevant accounts (stock, for returned goods, for example) to reflect the balance.

Credit Notes in SumUp Invoices

Fortunately, SumUp Invoices and other online invoicing software eliminate the need to double-check that every credit note is recorded appropriately in your books. A credit note has its own unique number, is automatically associated with the invoice for which it is created, and is included in the invoice’s outstanding balance.

As previously indicated, you can raise a credit note using SumUp Invoices based on the original invoice, but if necessary, you can also create a credit note without the original invoice.

To make it simple to distinguish credit notes from invoices in SumUp Invoices, each has its own tab and numbering system. Similar to your invoices, you can personalize them with your business logo to produce documents that are distinctive and expert.

The Financial Conduct Authority in the UK has granted permission to SumUp Payments Limited in accordance with the Electronic Money Regulations 2011 (registration number 900700).

FAQ

What is the meaning of credit note?

When a seller finds an error in an existing invoice, such as charging the wrong amount, or when a buyer returns the goods, the seller issues a credit note. It stands for the sum that the buyer overpaid and that the seller is obligated to reimburse to them.

Is a credit note a refund?

What is a credit note? A credit note is a written or digital note that a company issues to a client in lieu of a refund. Similar to a voucher, a credit note is only valid at the specific store, chain of stores, or company that issued it.

What is the difference between a credit note and an invoice?

Whereas credit notes are issued to indicate a return of funds or to cancel an invoice, invoices are issued to demonstrate that payment is due. In the field of accounting, invoices indicate a positive amount coming into your company, whereas a credit note indicates a negative amount leaving it.

What is the difference between credit and debit note?

A debit note is an acknowledgement and demand for payment of a debt. When mistakes or modifications are made to an already-existing invoice or order, a credit note is generated. Both kinds of notes are issued, which aids in the upkeep of accounting records and clarifies the amount owed—whether positive or negative.

Read More :

https://www.sumup.com/en-gb/invoices/dictionary/credit-note/

https://planergy.com/blog/credit-note/