Our top picks of timely offers from our partners

Whether using a credit card over the phone or online, the security code of the card is frequently required to finish the transaction. The security code acts as a deterrent against fraudulent credit card transactions and helps keep you safe from credit card fraud.

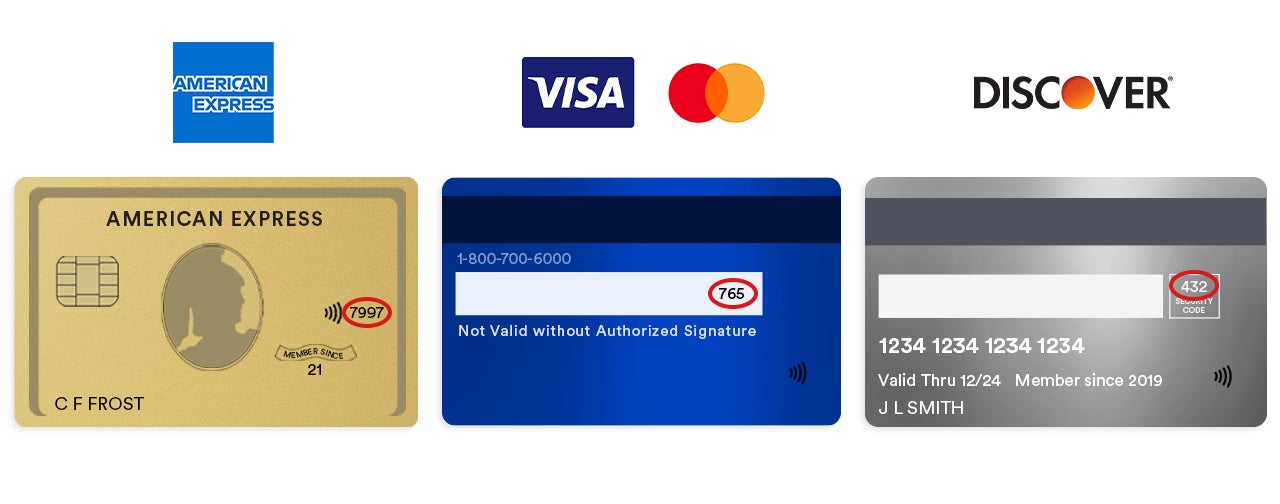

The card network determines where your card’s security code is located. CNBC Select describes where to find it and how security codes operate below.

How credit card security codes work

A three- or four-digit number called a credit card security code is used to thwart fraudulent transactions. This code may also be known as the Card Verification Value (CVV). Card Security Code (CSC), Card Verification Code (CVC or CVC2), and Card Identification Number (CID) are some other names for it that are commonly used.

Usually, this code is required when paying with a credit or debit card that isn’t physically present. For instance, when you shop online, the retailer might ask you to enter the security code at the checkout. Alternatively, if you’re making a purchase over the phone, you might have to give the code.

After a transaction is completed, merchants do not keep credit card security codes on file. This indicates that hackers cannot access the security codes by breaking into the electronic database of the merchant.

Finding your card’s security code

The security code for the majority of credit card networks, such as Discover, Mastercard, and Visa, can be found on the back of the card, to the right of the credit card number.

Check the right corner of both the front and back of your credit card to find out which network it is in if you’re unsure. One well-known credit card for travel, the Capital One Venture X Rewards Credit Card (see rates and fees), is part of the Visa network. The back of the card has the Visa logo.

- Rewards: 10 miles for every dollar spent on lodging and car rentals; 5 miles for every dollar spent on flights when booked through Capital One Travel; 2X miles for free on all other qualifying purchases

- Welcome bonus: After spending $4,000 on purchases in the first three months of opening your account, you will receive 75,000 bonus miles.

-

Annual fee

$395

-

Intro APR

None

-

Regular APR

19.99% – 29.99% variable APR

- Balance transfer fees are $0 at the Transfer Annual Percentage Rate (APR) and 4 percent of the total amount of each transferred balance that posts to your account at a promotional APR that Capital One may provide to you.

-

Foreign transaction fees

None

-

Credit needed

Excellent

- See rates and fees. Terms apply.

Read our Capital One Venture X Rewards Credit Card review.

However, as you can see from the card’s logo, the Citi Double Cash® Card—our top choice for the greatest flat-rate cash-back credit card—is a Mastercard.

- Earn 2% reward points on every purchase you make with an infinite 1% cash back when you buy, plus an extra 1% reward point as you pay for those purchases. To receive cash back, make on-time, minimum payments. Additionally, for a limited period of time, earn 5% of the total cash back on hotels, car rentals, and attractions that you book through the Citi Travel Portal through March 31, 2012.

- Welcome bonus: Spend $1,500 on purchases within the first six months of opening your account to earn $200 in cash back. The 20,000 ThankYou® Points that come with this bonus offer can be exchanged for $200 in cash back.

-

Annual fee

$0

- Intro APR0% for the first few months of 2018 on balance transfers; N/A for purchases

-

Regular APR

19.24% – 29.24% variable

- Balance transfer fee: For balance transfers completed within 4 months of account opening, an introduction balance transfer fee of 3 percent of each transfer ($5% minimum) applies; thereafter, a balance transfer fee of 5 percent of each transfer ($5% minimum) applies

-

Foreign transaction fee

3%

-

Credit needed

Fair/Good/Excellent

- See rates and fees. Terms apply.

American Express cards operate slightly differently from other credit cards, which can be confusing to new Amex cardholders. Two security codes are available for Amex cards: a four-digit code on the front and a three-digit number on the back. For regular transactions and purchases, use the code located on the front. But, for verification purposes, Amex might also ask for the number on the back. Terms apply.

Can you find your card’s security code without the card?

When using a security code for virtual or over-the-phone transactions, it serves as proof that you have a physical copy of your card. This increases the difficulty of someone using your card without your permission. Because of this, you need to have the card on you in order to access the security code.

If your card issuer allows it, you may be able to use a virtual credit card when shopping online if you don’t have your physical card with you. You can obtain a credit card number from your online bank account by using a virtual credit card. Since this number differs from the number on your actual card, it provides an additional layer of security by concealing and safeguarding the actual card information.

Money matters — so make the most of it. Receive professional advice, news, tactics, and other resources to help you make the most of your finances straight to your inbox. Sign up here.

When making transactions online or over the phone, a credit card security code aids in confirming that you have a physical copy of your card. It provides an extra degree of security against fraud, so take care with it. Don’t lend your card to anyone, and notify your credit card issuer right away if you misplace it or believe your information has been compromised.

Why trust CNBC Select?

Our goal at CNBC Select is to empower our audience to make wise financial decisions by offering them thorough consumer advice and excellent service journalism. Every credit card guide is built on thorough reporting from our staff of knowledgeable writers and editors who have in-depth understanding of credit card offerings. Although CNBC Select receives commissions from affiliate partners on a number of offers and links, we take pride in our journalistic standards and ethics and produce all of our content independently of our commercial team or any other outside parties. For additional details on our selection process for the top credit cards, view our methodology.

Stay informed by watching CNBC Selects’ in-depth coverage of credit cards, banking, and money, and by following us on Facebook, Instagram, Twitter, and TikTok.

FAQ

Where do you find the security code on your credit card?

Locating the security code on your card: The security code is typically located on the back of your card, to the right of the card number, with the majority of credit card networks, including Discover, Mastercard, and Visa. Check the right corner of your credit card’s front and back if you’re unsure which network it’s in.

Is a credit card security code 3 or 4 digits?

Credit cards from Visa, Mastercard, and Discover all have a three-digit CVV; the only credit card that uses a four-digit CVV is American Express. When making an online or phone purchase, for example, or when you are unable to give a merchant a physical card, the CVV is needed.

Is security code the same as CVV?

A credit or debit card’s card security code (also called CVC, CVV, or a number of other names) is a set of numbers that are printed—not embossed—in addition to the bank card number.

Where is the 3-digit card security code?

The three-digit security code known as the CVV2 (Card Verification Value 2) is printed at the conclusion of the signature panel on the reverse side of your card. When a card is not physically presented for a transaction—like when making an online purchase—CVV2 is typically used.

Read More :

https://en.m.wikipedia.org/wiki/Card_security_code

https://www.cnbc.com/select/how-to-find-your-credit-card-security-code/