Instant Life Insurance Quotes from Top Insurers

A single contract for group life insurance covers a number of individuals, usually those who are employed by the same business. The employer owns the policy, which covers the employees. If you pass away while your group insurance is in effect, your beneficiaries will be compensated.

The most popular kind of group life insurance is offered by employers. Nonetheless, group life insurance is provided to members of certain churches, unions, professional associations, alumni groups, and other affiliated organizations.

Group life insurance benefits are calculated using a variety of formulas. Some of the the most common types are below.

Fixed multiple-of-earnings benefit plans

These group life insurance policies link the amount of your death benefit to a multiple of your income, for example, twice your yearly salary. The payout is tied to your salary, so as your income rises, so does the level of protection.

Variable multiple-of-earnings benefit plans

Benefits from these group life insurance policies are based on multiples of your income up to a predetermined amount. For instance, the death benefit could be twice your annual earnings if you make over a certain amount, or it could be equal to your salary if you make less than a certain amount.

These group life insurance policies have a set monthly benefit that is paid to all employees in the same amount. Payouts between $10,000 and $25,000 are typically the most typical.

Payouts under a variable-dollar-amount plan may differ depending on your service history and earnings.

What Is the Purpose of Group Life Insurance?

The goal of group life insurance is to give employees and their families peace of mind by ensuring that, in the event that the policyholder passes away, they will have some financial security.

Companies provide group life insurance to help draw and keep talent. Businesses can effectively communicate to their workforce that they value and prioritize their well-being by providing group life insurance.

Group life insurance can give families that are having financial difficulties a lifeline. You should be aware, though, that group life insurance frequently falls short on its own. Because group life insurance is intended to offer extra protection above and beyond an individual life insurance policy, it is also referred to as supplemental life insurance.

You can determine how much life insurance you need by using our life insurance calculator.

Pros and Cons of Group Life Insurance

Group life insurance has advantages and disadvantages even though it’s a worthwhile benefit.

Advantages of group life insurance

- Due to employer reimbursement, group life insurance is typically less expensive than individual life insurance.

- Because there is no medical exam needed to qualify for group life insurance—unless you want to purchase additional group life—it is frequently simpler to do so.

- Obtaining group life insurance is simple because you can enroll during open enrollment or employee onboarding.

- You might be able to include your spouse or dependents in your coverage.

Disadvantages of group life insurance

- If you leave your job, you often lose coverage. The only exception is if your policy is “portable,” meaning that even after you quit your job, you can keep purchasing group life insurance at your own expense.

- Generally speaking, a group life insurance policy’s death benefit is less than that of an individual policy.

- Unlike permanent life insurance, most group life insurance policies have no cash value, so you cannot borrow against them.

Summary: Group life insurance pros and cons

It makes sense to enroll in group life insurance if your employer provides it for free. In most cases, it is free of charge and gives your beneficiaries a little bit more financial stability in the event of your passing. Group life insurance is typically less expensive than individual life insurance, even if you do have to pay for it.

Beyond that, if your health prevents you from being eligible for an individual policy, group life insurance can be a great way to get coverage. This is a result of the underwriting requirements for group policies frequently being more relaxed.

Requirements for Group Life Insurance

Typically, in order to be eligible for group life insurance, you have to be a current employee of the business providing the policy. Certain policies might need you to put in a specific amount of hours each week in order to be eligible, while others might be open to all workers, regardless of status.

Premiums for Group Life Insurance

Group life insurance premiums are frequently covered in full or in part by the employer. Your salary may be withheld if you are required to pay a portion of it. Your premium may vary based on your age, income, and smoking habit, among other things. Additionally, your employer might provide varying coverage options at various price points, allowing you to customize your coverage to fit your needs and budget.

The Cost of Group Life Insurance

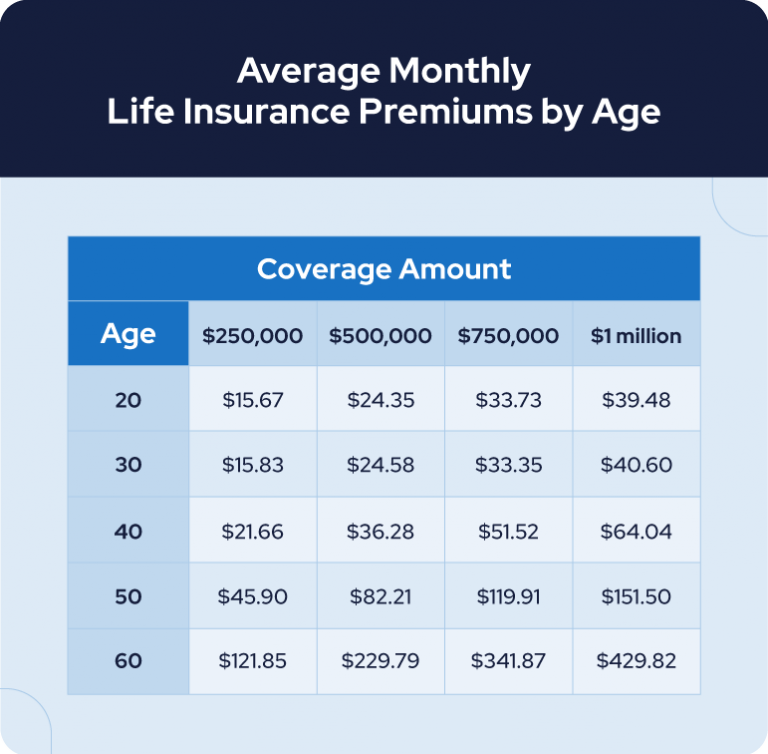

The cost of group life insurance varies based on your employer, the life insurance provider, and the group’s attributes, like the average employee age. Group life insurance obtained through an employer typically has relatively low average costs.

For instance, let’s examine the group life insurance offered by two of the biggest companies in the United States: Walmart and Amazon. S.

Walmart provides company-paid life insurance to full-time employees up to $50,000 in coverage, based on their yearly salary. Beyond this, hourly workers can purchase group life insurance for up to $200,000, and salaried workers and drivers can purchase up to $1 million in coverage.

A 40-year-old full-time worker at Walmart who abstains from tobacco use receives $ 0295 for $1,000 or $2. 95 per biweekly pay period for $100,000 in additional coverage.

Most full-time and part-time employees of Amazon are eligible for free basic life insurance, which is equal to twice their yearly salary. Workers may choose to purchase up to ten times their base yearly salary in additional coverage.

For example, a 40-year-old full-time Amazon employee will pay $0. 059 for every $1,000 of additional coverage. That employee would pay a $5 monthly premium if they wanted to add $100,000 to their group life insurance. 90.

Compare Life Insurance Companies

If the insured passes away while the policy is in effect, group life insurance policies pay out a death benefit. Beneficiaries are free to use the death benefit however they see fit, including paying for daily expenses or funeral expenses.

Additionally, accelerated death benefits—which pay out a portion of the death benefit amount while you’re still alive if you’re diagnosed with a terminal illness—may be available through group life insurance.

What is the difference between group life insurance and life insurance?

Individual life insurance is a policy you purchase for yourself, whereas group life insurance is normally offered by an employer and covers every employee of the business. The primary advantage of group life insurance is its typically lower cost in comparison to individual policies. Nevertheless, group life insurance typically only offers minimal coverage, and it usually expires if you quit your job.

Individual life insurance provides greater flexibility because it allows you to select from a range of coverage durations, death benefit amounts, and additional coverage options known as life insurance riders. Generally speaking, individual life insurance costs more than group life insurance.

What are the types of group life insurance?

If your employer provides group life insurance, you can choose from three main types of coverage.

- Employees are not able to refuse basic group life insurance, also known as supplemental life insurance, and it is usually free. For this reason, if you can, it makes sense to sign up for basic group life insurance.

- If you would like more group life insurance than what your employer provides for free, you can purchase additional voluntary life insurance for yourself. If you choose to purchase voluntary life insurance, the insurance provider may require you to submit a “Evidence of Insurability” form for approval.

- The additional coverage you can purchase for your partner, spouse, or children through your employer’s benefits is known as voluntary dependent life insurance.

What is the most common type of group life insurance?

Term life insurance is the most popular kind of group life insurance. Coverage renews each year you’re employed. If you pass away while the group life policy is in effect, your beneficiaries will be paid a death benefit.

Can I convert a group life policy into an individual life policy?

Certain group life insurance policies allow you to convert to an individual policy in the event that you leave your employer. However, before you do so, you should be aware that your premium after conversion might be more than it would be if you bought an equivalent individual life insurance policy. That is, unless you suffer from a health condition that makes it costly or difficult for you to be eligible for your own policy.

Please rate this article. Email: Please enter a working email address. Comments: We would love to hear from you. Please enter your thoughts. Send feedback to the editorial team. Something went wrong. Thank you for your feedback! Invalid email address Please try again later. Buying Guides.

Next Up In Life Insurance

Financial writer Cassidy Horton focuses on banking and insurance. She possesses an MBA and a public relations bachelor’s degree in addition to hundreds of online articles published by Finder, The Balance, and other publications. com, Money Under 30, Clever Girl Finance, and more. Outside of work, she enjoys reading and hiking. lorem Is it really your intention to put your decisions on hold? The Forbes Advisor editorial staff is impartial and independent. We receive compensation from the businesses that advertise on the Forbes Advisor website in order to support our reporting efforts and keep this content available to readers for free. This compensation comes from two main sources.

FAQ

Who pays the premiums for group credit life insurance?

Group life insurance premiums are frequently covered in full or in part by the employer. Your salary may be withheld if you are required to pay a portion of it.

Who pays for group credit life insurance?

Premiums: Usually, the borrower includes the cost of group credit life insurance in the amount they repay on their loan. The loan amount, the borrower’s age, and the loan term are among the variables that determine the premium amount.

Who is responsible for paying the policy premiums in credit life insurance?

Typically, credit life insurance pays off the borrower’s outstanding balance on a sizable loan. Generally, the policy entails a premium that the borrower pays, usually incorporated into their monthly loan payment, to guarantee full payment to the lender in the event of the borrower’s death before the loan is paid off.

Who is responsible for premium in group insurance?

The organization and its members split the premiums, and for an additional fee, members’ families and/or other dependents may be covered. Offering group health insurance to employees can result in advantageous tax benefits for employers.

Read More :

https://quizlet.com/194870357/life-insurance-policies-provisions-options-and-riders-flash-cards/

https://www.forbes.com/advisor/life-insurance/group-life-insurance/