Similar to the gold standard in the financial sector, the three letters AAA stand for the safest possible investment.

The U. S. had proudly maintained that excellent debt rating for many years, signifying its position as the largest and safest economy in the world, having never experienced a default on its debt.

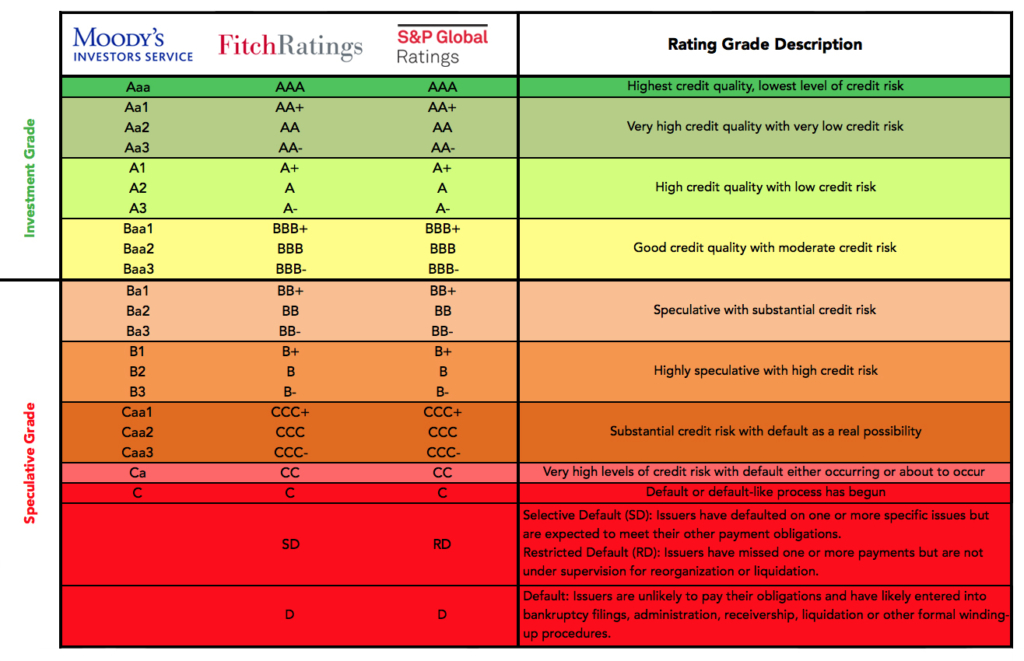

But on Tuesday, Fitch Ratings cut the U. S. debt downgraded from AAA to AA, in part due to the way the federal government managed the debt crisis two months prior. That action mirrored S’s comparable downgrade.

Fitch expressed concern about the nation’s failing finances and serious concerns about the government’s capacity to handle the mounting debt load due to pronounced political differences, as demonstrated by the tense negotiations over the debt ceiling that nearly resulted in a disastrous government default.

Following Janet Yellen’s scathing criticism of Fitch’s ruling, the Dow Jones Industrial Average dropped by more than 300 points.

HOW DID THE GOVERNMENT GET TO THIS POINT?

Only a few weeks have passed since the White House and Congress broke their impasse over raising the borrowing cap for the government. A late-May agreement reduced the debt ceiling by approximately $1 and suspended it for two years. 5 trillion in spending over the next decade. Following Treasury Secretary Janet Yellen’s warning that the government would default on its debt, negotiations came to an agreement.

The Biden administration reacted angrily to the move. Yellen stated on Wednesday that Fitch’s “deceptive evaluation is founded on antiquated information and neglects to acknowledge advancements in various metrics, such as governance, that we have witnessed during the previous 2.5 years.” ”.

“We have seen both parties come together to pass legislation to resolve the debt limit, despite the impasse,” Yellen stated.

However, Douglas Holtz-Eakin, the president of the American Action Forum and a former CBO director, stated that Fitch made the correct choice, considering the dearth of initiatives in Washington to address the government’s chronic budget deficit.

He stated, “This is about a fundamental mismatch between our revenue capabilities and our spending growth over the long term.”

Standard & Poor’s removed its coveted triple-A rating of U. S. debt in 2011 following a comparable stalemate concerning the borrowing cap.

Fitch said that the ratio of U. S. The government’s debt in relation to the size of its economy is expected to increase from approximately 20113% this year to more than 20118% in 202025, which is more than twice as high as is usually the case for governments with triple-A and even double-A ratings.

WHAT TYPICALLY HAPPENS WHEN DEBT IS DOWNGRADED?

rating companies such as Fitch and its affiliates, Standard

When a debt issuer’s credit rating is downgraded, it usually means that the issuer must pay a higher interest rate to offset the increased default risk that the debt may pose.

WHAT COULD THAT MEAN FOR U.S. TAXPAYERS?

It is mandatory for numerous pension funds and other investment vehicles to retain only investments with excellent credit ratings. Investment funds would have to sell any bonds they own if a state or city, for instance, saw a decline in credit worthiness. In order to draw in more investors, the government issuing those bonds would have to pay a higher interest rate on its subsequent bonds.

If that were to happen to U. S. Treasury securities, the federal government might have to pay higher interest rates, increasing the cost of borrowing for both the government and the general public.

WILL U.S. BORROWING COSTS RISE?

Few economists think that such an outcome will actually occur. Instead, they think Fitch’s downgrade will have little impact. According to Goldman Sachs, very few pension funds are restricted to holding only triple-A rated debt, which translates to the current AA from Fitch and Standard & Poor’s.

According to Alec Phillips, chief political economist at Goldman Sachs, “we do not believe there are any meaningful holders of Treasury securities who will be forced to sell due to a downgrade,” in a research note.

Large U. S. According to Phillips, in an interview, banks that are mandated by regulators to hold Treasurys won’t see any changes in those regulations simply because of the downgrade because regulators will still view them as safe investments.

For most investors, U. S. Treasury securities are essentially in a class by themselves. The U. S. The world’s largest market for government bonds makes it simple for investors to purchase and sell Treasurys as needed. Due to the country’s robust economy and long history of political stability, Treasury bonds are now viewed by many investors as being almost exactly equal to cash.

Downgrades by rating agencies usually affect smaller, less well-known debt issuers more, like local governments. In those circumstances, Phillips noted, even major investors might not be well-informed about the bond’s creditworthiness and may be more dependent on the rating agencies.

However, he said, that isn’t actually the case for Treasury bonds and notes. He stated that major banks and investment funds make their own decisions regarding Treasury securities and do not depend on rating agencies. Fitch’s analysis also didn’t provide much new information, he added. Other organizations, like the impartial Congressional Budget Office, have calculated where U S. government debt is headed.

WHAT DOES FITCH MEAN BY ‘GOVERNANCE’?

Fitch downgraded the government citing a decline in “governance,” a reference to the ongoing battles in Washington over the last 20 years that have resulted in government shutdowns or even brought the government dangerously close to defaulting on its debt.

“The ongoing political impasses over debt limits and impromptu agreements have diminished trust in fiscal management,” Fitch stated.

Meanwhile, Fitch is pointing out that even compromise laws have not been able to effectively address the long-term causes of the federal government’s debt, particularly the entitlement programs for the elderly like Social Security and Medicaid.

According to Fitch, there hasn’t been much progress made in addressing medium-term issues like growing Medicare and social security costs as a result of an aging population.

FAQ

Why did US credit rating go down?

What led to the change in the U. S. Moody’s attributed the change in its credit outlook to deteriorating fiscal stability, as demonstrated by the government’s risk of defaulting on its debt this summer following Congress’s inability to raise the debt ceiling.

Why did Fitch lower credit rating?

The lack of political will to address the primary causes of the deficit, which include spending on programs for the elderly such as Social Security and Medicare and ongoing reductions in tax rates for the majority of households, was one factor in Fitch’s downgrade.

Why has the US been downgraded?

The US was downgraded from the highest AAA rating to a notch lower AA rating by the agency, which attributed the slight downgrade to a “steady deterioration in standards of governance” on debt and fiscal matters among other issues in recent decades.

When did Fitch downgrade US?

Fitch Ratings, London, August 1, 2023: The United States of America’s Long-Term Foreign-Currency Issuer Default Rating (IDR) has been downgraded from AAA to ‘AA’ by Fitch Ratings. After removing the Rating Watch Negative, a Stable Outlook was assigned.

Read More :

https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023

https://events.fitchratings.com/insidetheratingsussovereigndow