Our top picks of timely offers from our partners

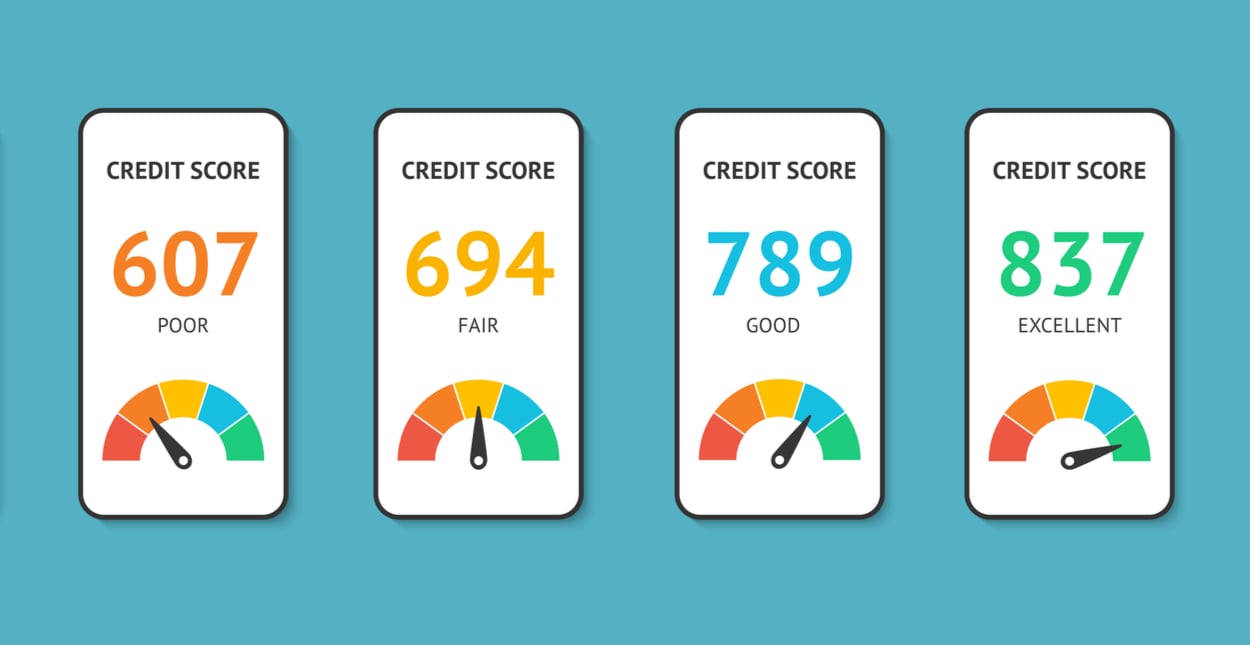

Lenders use your credit score, which is a three-digit figure, to decide whether to approve you for financial products like loans and credit cards.

While credit scores normally range from 300 to 850, it can be difficult to determine which version you are being assessed on during the application process because there are numerous variations, from base scores to industry-specific scores.

It can be challenging to determine what credit score range you fall into and which products you have the best chance of qualifying for when you check your score with your credit card company or on a personal finance website only to discover that it differs on another. Additionally, when a lender obtains your credit score, they might do so from Experian, Equifax, or TransUnion, or they might ask for a particular version that differs from the one you checked.

The majority of credit scores include the same elements, including length of credit history, utilization rate, payment history, number of new inquiries, and range of credit products. But there could be variations in scores for a number of reasons, which CNBC Select explains below.

6 reasons why your credit score differs

- Credit scoring model: A variety of models are available to score your credit history. However, FICO or VantageScore are the two primary credit scoring models that are usually used by lenders. Both businesses assess the same primary elements of your credit history, such as your payment history and utilization rate, but they weigh each element differently based on their own formulas.

- Score version: There are numerous credit score variations that are divided into base scores and scores unique to certain industries. Base scores, such as FICO® Score 8 or VantageScore 3. 0, show lenders the likelihood you’ll repay any credit obligation. Industry-specific scores, like the FICO® Auto Score 9, which is used to make auto loan decisions, indicate your likelihood of repaying a particular loan.

- Credit bureau: Information from your credit report, which is obtained from one of the three main credit bureaus (Expperian, Equifax, or TransUnion), is used to calculate credit scores. Your score varies according to the data that each bureau received; this is covered in more detail below.

- Details given to the credit bureaus: Not all of the information about your credit accounts may be given to the credit bureaus. It’s surprising to learn that lenders are not obligated to report to any or all of the three agencies. Even though the majority do, there’s no assurance that the data will be consistent, which could lead to variations in your scores.

- Date scores are accessed: There could be differences if you check your credit score at different times because one of the scores might not be current.

- Errors on your credit report: Any inaccuracies on your credit report may be reflected in your credit score. Your credit score from a report that has errors may differ from one that doesn’t if the errors are limited to one bureau. To protect your credit score, you should dispute any inaccuracies on your credit report as soon as possible.

Which credit score matters the most?

Although there is no precise answer as to which credit score matters the most, lenders have a clear preference: FICO%C2%AE%20Scores are used in over 90% of lending decisions.

Even though it can assist you in selecting which credit score to check, you still need to take the purpose of your credit score check into account. A popular base score like FICO® Score 8 is useful if you’re just checking your credit score to keep tabs on your finances. This version is also useful for determining the credit cards that you are eligible for.

You might want to check a credit score tailored to that particular industry if you intend to make a specific purchase. The precise scores used for different financial products are listed by FICO. If you want to finance a car with an auto loan, FICO® Auto Scores are the best option; however, if you want to buy a house, you should look at FICO® Scores 2, 5, and 4.

Don’t miss:

FAQ

Which credit score is most accurate?

However, this does not influence our evaluations. VantageScore® and FICO® are the two main credit scoring models, and both are equally accurate.

Is it normal to have different credit scores?

First things first: It’s entirely normal for agency scores to vary slightly. Lenders are responsible for selecting which information to report to the major credit agencies and to which agencies in the first place.

Why is my FICO score different from TransUnion and Equifax?

Your Equifax credit score and FICO score may vary based on which credit report is utilized to compute the score because the data in your credit reports from each bureau may vary.

Which credit score matters most?

Even though 90% of the best lenders use FICO%C2%AE%20Scores%E2%98%89%20, there isn’t a single credit score or scoring system that is the most significant. In actuality, the lender who is willing to give you the best lending terms will use the score that matters the most.

Read More :

https://www.cnbc.com/select/why-are-my-credit-scores-different/

https://www.experian.com/blogs/ask-experian/why-do-i-have-so-many-credit-scores/