You Have Late or Missing Payments

The most significant factor in your FICO%C2%AE%20Score%E2%98%89%20, the credit scoring model that 90% of the best lenders use, is your payment history. It constitutes fifty percent of your score, and even one late or missed payment can have a detrimental effect. Therefore, it’s crucial that you make all of your payments on schedule.

Credit issuers will report a delinquent payment to at least one of the three major credit bureaus if it is more than thirty days past due. This will probably cause your score to decline. Payments that are 90 or 60 days past due will impact your score even more.

The credit issuer may send your debt to a collection agency if these delinquencies are not paid, and the collection account will be noted on your credit report. If you have an open account with a good payment history, the records of your late and missed payments will remain on file for seven years. If the account is closed in good standing, the records will remain on file for ten years. Make sure you always pay your bills on time so that your good credit history will continue to support your score for many years to come.

You Recently Applied for a Mortgage, Loan or New Credit Card

Lenders will obtain a copy of your credit report each time you apply for a new credit line in order to assess your creditworthiness. When determining whether to lend to you, they consider factors such as your credit utilization, payment history, and the kinds of accounts you currently have.

Every time you give someone else permission to look up your credit history—like a lender—a hard inquiry is made, which appears on your credit report and may have a small impact on your score.

It’s normal for your credit profile to grow older and start to receive hard inquiries. However, applying for too much credit too quickly can hurt your credit scores and make it less likely that lenders will grant you new credit.

A new hard inquiry may result in a short-term decrease in your score, contingent on the number of inquiries you currently have. Additionally, any impact on your credit score ought to go away in a year or so.

Your Credit Utilization Has Increased

Your credit score may quickly decline if you use your credit card to the maximum amount. The second most crucial element in determining your FICO® Score is your credit utilization ratio, which can go up if you make a big purchase or just accumulate debt on your card, depending on its credit limit. Lenders may conclude that you are overextended and not in a position financially to take on new debt if your credit utilization has increased.

By totaling up all of your credit card balances at any one time and dividing that amount by your total revolving credit limit, you can determine your overall credit utilization ratio. In the event that, for instance, you normally charge $2,000 per month and your total credit limit for all of your cards is $10,000, your overall utilization ratio will be 2020%.

Both the total credit utilization for all credit cards and the utilization ratio for each card are taken into account by credit scoring models. %20You should strive to maintain your credit utilization ratio below 2030%, and for the highest scores, below 2010%. Thus, to maintain a healthy credit score, if your total credit limit is $10,000, make sure that your balances are never more than $3,000.

One of Your Credit Limits Decreased

Reducing your credit limit can have a similar negative impact on your credit scores as maxing out your credit cards by raising your credit utilization ratio.

Assume, for the purposes of this example, that you had a $10,000 credit limit and a $3,000 balance. In this case, your utilization ratio would be 30%. In the event that a credit card issuer reduced your limit to $6,000 while maintaining the same balance, your utilization ratio would shift to 0%. This could cause your credit score to drop.

Initial credit limits are determined by credit card issuers using a variety of criteria, such as your income, debt-to-income ratio, credit score, and credit history. If, among other things, you haven’t been using your card much or if you regularly miss payments or pay late, the issuer may reduce your credit limit.

If you think your credit limit is too low, you can open a new credit card account or ask your current issuers to raise your credit limit. However, be aware that if your credit limit has recently decreased, getting an increase might be difficult. It might be better to wait to ask for more credit until your credit score rises.

You can gain more insight into your credit score fluctuations by monitoring your credit utilization ratio, even if your credit limits are decreasing or your balances are rising.

You Closed a Credit Card

Think twice before closing a credit card you dont use. Closing a credit card account can affect your credit score because it will raise your utilization ratio and possibly shorten your credit history.

Your total utilization ratio will no longer include the credit limit you removed when you cancelled your credit card account, potentially lowering your scores. Your credit score will be impacted by the closing of a long-standing credit card account, which can also reduce your average credit age.

Your credit history’s duration determines the 2015% of your FICO%C2%AE%20Score; thus, a longer credit history means higher scores. However, bear in mind that your account may stay on your credit report for up to ten years and help establish a good payment history if it is closed in good standing, which means you paid all of your bills on time.

Keep your credit card open to preserve your credit limit and length of credit history, unless the card has a high annual fee that you cannot afford or it tempts you to spend more than you should.

There Is Inaccurate Information on Your Credit Report

One of the best ways to make sure there is no erroneous information in your file is to regularly check your credit reports. Errors do occur, though they are uncommon, and it’s possible that false information about you or your payment history on your credit report is lowering your credit scores.

If there is any inaccurate information in your report, it may have been reported by a lender by mistake. It might also indicate that you are a victim of identity theft. You are entitled to contest information that you don’t understand or that you think might be fraudulent. As soon as possible, dispute any information that you feel is incorrect with each of the three credit bureaus.

You’ve Experienced a Major Event Such as Foreclosure or Bankruptcy

Your credit scores are harmed by the late payments that frequently precede bankruptcy or foreclosure, and the actual events themselves may exacerbate the situation.

The legal process known as bankruptcy is started by debtors seeking relief from debt payments, and it is the single event that damages a consumer’s credit the most. The second worst credit damage after bankruptcy is foreclosure, which occurs when your mortgage lender seizes possession of your home, usually after four months of nonpayment.

Both of these things can lower your credit score and prevent you from getting certain kinds of loans in the future. If you have experienced a foreclosure in the past, for example, a mortgage lender might be reluctant to accept you as a borrower. A valid foreclosure record will remain on your credit record for seven years.

Depending on the type of bankruptcy filed, a bankruptcy’s duration on a credit report varies. For example, Chapter 7 bankruptcy stays on your record for ten years after the date of filing, whereas Chapter 13 bankruptcy stays on record for seven years.

What Is a Good or Bad Credit Score?

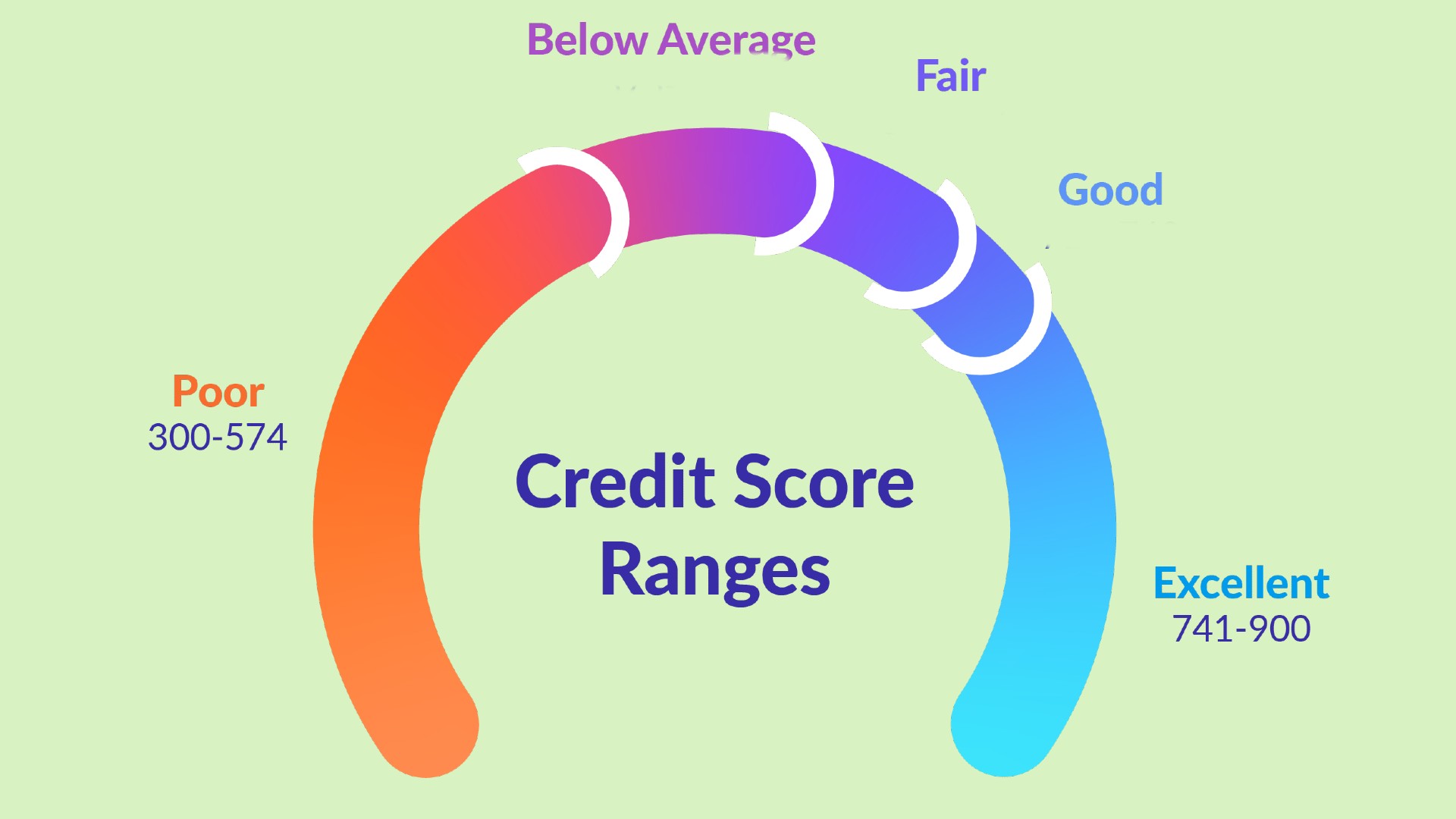

A score between 670 and 739 on the FICO® Score range—which employs a scoring range of 300 to 880—is regarded as good. Scores above 739 are considered very good or exceptional. Scores below 669 are considered fair or poor. In 2022, the average FICO® Score in the U. S. was 714, according to Experian data.

Having a high credit score has many advantages, one of which is that it could eventually save you a lot of money and stress. You can be eligible for more credit products with lower interest rates if you have good credit. However, since your profile poses a greater risk to the lender, low credit scores may prevent you from being approved for certain credit products or may result in the approval of credit products at higher interest rates.

Ways to Improve Your Credit Scores

If you want to raise your credit scores, these pointers can be useful.

- Pay your bills on time. One of the most important steps to obtaining and maintaining a high credit score is doing this. Setting up automatic payments is the best way to ensure that you never forget a bill and pay on time. However, to prevent an overdraft, make sure you have adequate funds in the linked bank account.

- Minimize overall debt. Try not to use credit to purchase things you can’t afford to pay for with cash or that you won’t be able to pay off by the end of the month. This maintains your credit utilization ratio low over time and your payments reasonable. At the end of each month, you should aim to have your credit card balance zero.

- Monitor your credit regularly. You can check your credit score for free in a number of ways, such as through Experian By doing this, you’ll be able to promptly spot drops in your score and make any necessary course corrections. Experian offers free credit monitoring to help you stay on top of both your credit report and your FICO® Score. They can also notify you when there are any changes to your credit report.

- Avoid applying for unnecessary credit cards. Several cards come with expensive annual fees, and having too many cards could lead to overspending.

- Practice responsible spending habits. Creating a budget, even a simple one that divides your expenses into several general categories and doesn’t need a lot of maintenance, can assist you in long-term living within your means.

Handling a Dip in Credit Scores

While a credit score decline can be upsetting, it doesn’t have to be irreversible. There are strategies to raise your score once more and stop it from falling in the future.

Check your credit score for free with Experian to view customized details about what caused your score to fluctuate and suggestions for credit moves you can take to raise your score. Keep in mind that credit scores are dynamic and that you can raise your own by adopting healthy habits. This is a powerful realization that you can also apply to other areas of your financial life.

Learn what it takes to achieve a good credit score. Check your free Experian FICO® Score now to see what’s boosting and depressing your score.

No credit card required

How Good Is Your Credit Score?Enter Your Credit ScoreExamples:

Learn what it takes to achieve a good credit score.

FAQ

Why would my credit score drop for no reason?

No, a credit score cannot fall without cause, but it may appear that way. Formulas are used to calculate scores, so paying off debt, lowering your credit limit, canceling an account, or having a higher credit card balance than usual can all have an adverse effect on your score.

Why is my credit score going down if I pay everything on time?

After making all of your loan or credit card debt payments, it’s possible that your credit scores will decline. If paying off debt has an impact on specific variables such as your credit mix, length of credit history, or credit utilization ratio, it may result in a decrease in your credit scores.

Why has my credit score gone down when nothing has changed?

A late payment was recorded: If you haven’t paid on time lately, your credit score may suffer. Your payment history is another important credit score factor. Your payment history for each account listed should be visible if you check your credit reports.

Why is my credit score so low when I have no debt?

Your credit score may be low even if you have no credit because of a number of weighted factors, such as the length of your credit history or credit mix.

Read More :

https://www.experian.com/blogs/ask-experian/why-did-my-credit-score-drop/

https://www.transunion.com/blog/credit-advice/my-credit-score-dropped-no-changes-on-my-report