Why are Revenues Credited

The double-entry system in accounting is used to maintain the balance of the accounting equation, which is assets = liabilities + equity. Under this system, each transaction affects at least two accounts. There is an equivalent and opposite credit entry for each debit entry.

Credits are used to show an increase in equity resulting from business operations in the context of revenues. In other words, when a company generates income, its equity and assets—typically cash and accounts receivable—also rise. Under double-entry accounting, increases in equity are recorded as credits.

Here’s a simplified explanation of why revenues are credited:

Accounting Equation:

Effect of Revenue on the Equation:

A company’s assets—such as cash and accounts receivable—usually increase as it generates revenue. On the other side of the equation, this increase must be equaled, usually by raising equity.

Double-Entry Accounting:

The increase in assets is debited and the corresponding increase in equity (in this case, revenue) is credited in order to balance the books.

Journal Entry for Revenue Earned:

Let’s say a business receives $5,000 for its consulting services. The journal entry would look like this:

- Debit Accounts Receivable $5,000 (increase in assets)

- Credit Service Revenue $5,000 (increase in equity)

The business recognizes the increase in equity by crediting the revenue account, maintaining the balance of the accounting equation.

Why This Matters:

- Accurate Financial Statements: Crediting revenue guarantees that the balance sheet and income statement accurately depict the state and performance of the company’s finances.

- Regulatory Compliance: Organizations can adhere to accounting standards like International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) by using the double-entry system and crediting revenue appropriately.

- Precise revenue tracking facilitates internal decision-making, including budgetary allocation, performance reviews, and long-term planning.

Comprehending the rationale behind revenue crediting is essential for comprehending the double-entry accounting system and is necessary for precise and efficient financial reporting.

Example of Why are Revenues Credited

Let’s look at a simple example to show you why revenues in accounting are credited. Well use a fictional company, “LawnCare Inc. “, that provides lawn maintenance services.

Scenario:

LawnCare Inc. gives a customer lawn care services and submits a $500 invoice. The customer agrees to pay the invoice in two weeks.

Journal Entry:

To record this transaction using double-entry accounting, LawnCare Inc. would make the following journal entry:

- Debit Accounts Receivable $500 (to record an increase in assets)

- $500 in Credit Service Revenue (more precisely, revenue to reflect an increase in equity)

The accounting equation can be used to conceptualize the entry:

- Assets Increase: By invoicing the customer, LawnCare Inc. has increased its “Accounts Receivable,” an asset account, by $500. Accounts Receivable is debited as assets rise on the debit side.

- Equity Increase: At the same time, LawnCare Inc. has earned $500 in revenue, which increases its equity. In the double-entry system, a credit is recorded for an increase in equity. Hence, we credit Service Revenue by $500.

Why This Matters:

- Balance Sheet: Following this transaction, there will be a $500 increase in “Accounts Receivable,” an asset, and a $500 increase in “Equity,” a subset of “Service Revenue,” The accounting equation remains balanced.

- Income Statement: The earnings for the period will be shown as $500 under the revenue section of the income statement.

- Financial Analysis: The organization gives accurate information for internal analysis as well as external parties like investors, analysts, and regulators by accurately crediting the revenue.

- Cash Flow Forecasting: Accurate forecasting of future cash flows is made possible by recognizing revenue, even in cases where cash has not yet been received. This aids in business planning and decision-making.

In summary, by crediting the Service Revenue account, LawnCare Inc. maintains the balance of its accounting equation and the accuracy of its financial statements, meeting the double-entry accounting system’s requirements.

FAQ

Why is revenue part of credit?

There is an equal and opposite credit entry for each debit entry. Credits are used to show an increase in equity resulting from business operations in the context of revenues. In other words, when a company generates income, its equity and assets—typically cash and accounts receivable—also rise.

Why is revenue treated as credit?

Since revenues is shown as a component of equity, it has a normal balance of credit. However, since these are accounts that are used against revenue, expenses are noted as debits.

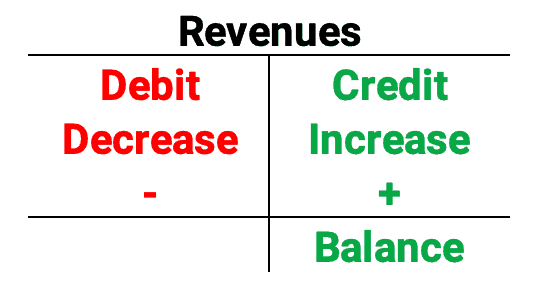

Is revenue a debit or credit?

Because revenues raise owner or stockholder equity, they are considered credits in bookkeeping. Remember that there must always be a balance in the accounting equation: Assets = Liabilities · Owner’s Equity.

Why is income a credit?

To put it simply, income is the sum of money that a business gets in return for selling goods and services or generating revenue. Income is recorded on the credit side of the ledger because it raises the balance of the equity account.

Read More :

https://www.superfastcpa.com/why-are-revenues-credited/