What Is a Line of Credit?

A bank or other financial institution’s flexible loan is called a line of credit. A line of credit is a predetermined sum of money that you can access and use as you see fit, much like a credit card with a predetermined credit limit. After that, you can pay back what you used right away or gradually.

Using a line of credit will incur interest payments, just like a loan. The bank must approve borrowers, taking into account a number of factors such as your relationship with the bank and/or credit rating. Although lines of credit are less popular than credit cards, they typically carry a lower risk.

In contrast to personal loans, the interest rate on a line of credit is typically variable, which means that it may fluctuate in tandem with changes in the general market rate. Because of this, it may be challenging to estimate how much the money you borrow will ultimately cost you.

When a Line of Credit Is Useful

:max_bytes(150000):strip_icc()/Basics-lines-credit_final-0c20f42ed1624c349604fdcde81da91c.png)

While lines of credit can be used to purchase goods for which a bank might not typically approve a loan, they are not meant to be used to finance one-time purchases like homes or vehicles. Individual credit lines are typically used to finance projects with unknown costs or for unforeseen expenses.

Problems With Lines of Credit

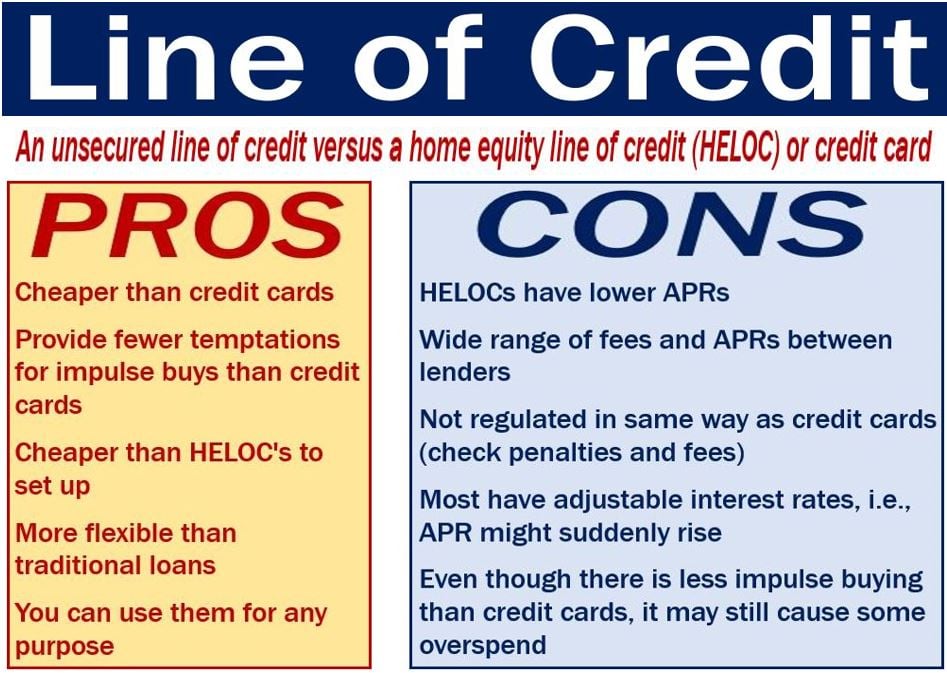

There are advantages and disadvantages to lines of credit, just like with other loan products. Make sure you have the financial means to repay any money you take out from a line of credit before using it. It is possible that you won’t be approved for this product if your credit is bad.

Since personal lines of credit are frequently unsecured and not secured by collateral, they may be more expensive than other loan kinds like mortgages and auto loans. However, home equity lines of credit, or HELOCs, do require your equity as collateral.

If you do not use the line of credit, some banks will charge a maintenance fee, which can be paid monthly or annually. Interest also accrues from the moment money is borrowed. The fact that lines of credit can be drawn upon and repaid at any time makes the interest calculations associated with them more challenging for certain borrowers. You might be shocked by the amount of interest you ultimately pay.

When expenses are unknown up front, lines of credit can be helpful. They can also be helpful for significant costs like home renovations or weddings. Plans for overdraft protection may also include personal credit lines.

Comparing Lines of Credit to Other Types of Borrowing

Comparing lines of credit to other financing options such as credit cards, personal loans, and payday loans reveals certain similarities and differences.

Credit Cards

Similar to credit cards, lines of credit have predetermined limits, meaning that you can only borrow a specific amount. Similar to credit cards, different lenders have different policies regarding exceeding that cap. Like a credit card, a line of credit is basically preapproved and the funds are available for the borrower to use for any purpose at any time. Last but not least, despite the possibility of annual fees, neither a credit card nor a line of credit charge interest until a balance is due.

Certain credit lines, like home equity lines of credit (HELOCs), can be secured with real estate in contrast to credit cards.

There will always be a minimum payment due each month on credit cards, and if it is not made, the interest rate will rise dramatically. Credit lines may or may not have comparable requirements for an immediate monthly repayment.

Personal Loans

A line of credit has the same requirements as a traditional loan, including acceptable credit, fund repayment, and interest. Similar to loans, prudent use of credit lines can raise a borrower’s credit rating. Money from personal loans and credit lines can be used for anything.

On the other hand, a loan normally has a predetermined repayment schedule and is granted for a set amount of time. A line of credit, on the other hand, typically has a variable interest rate and is more flexible. Your line of credit will cost more as interest rates rise, but fixed loan payments won’t change.

Payday and Pawn Loans

Payday and pawn loans share certain similarities with credit lines, such as the flexibility to use the money however you please. The differences, however, are considerable:

- The cost of funds for anyone who is eligible for a line of credit will be significantly less than that of a payday or pawn loan.

- With a payday or pawn loan, your credit is evaluated more easily (possibly without a credit check at all) and you receive your money faster.

- Generally speaking, a line of credit is far larger than a payday or pawn loan.

How Do I Qualify for a Line of Credit?

You must fulfill the requirements of the lender in order to be eligible for a line of credit. These requirements usually include demonstrating your creditworthiness with a minimum credit score, having enough income, and meeting other requirements.

What Are the Disadvantages of a Line of Credit?

You run the risk of accruing more debt than you can handle with any loan product. Your credit score will drop if you are unable to repay the credit you use. If the interest rate on a line of credit is variable, you run the risk of it increasing, which would increase the total amount of interest you pay.

How Do I Pay Back a Line of Credit?

You reimburse a line of credit by paying the lender the bare minimum each month. Your monthly bill will include your advances, interest, and fees. You might have to pay the full amount due each year.

The Bottom Line

Like any financial instrument, lines of credit have benefits and drawbacks that vary based on how they are used. On the one hand, taking out too much credit card debt can lead to financial difficulties. However, lines of credit can be an affordable way to cover unforeseen or large costs.

Shop around and carefully review the terms, especially the fees, interest rate, and repayment schedule, as you would with any loan. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

What is a line of credit and how does it work?

A line of credit is a predetermined sum of money that you can access and use as you see fit, much like a credit card with a predetermined credit limit. After that, you can pay back what you used right away or gradually. Using a line of credit will incur interest payments, just like a loan.

Is it good to have a line of credit?

A line of credit (LOC) can be a great tool that allows you to easily access funds when you need them. It’s a fairly straightforward concept: If you are granted a LOC, you are permitted to borrow up to the maximum amount. Similar to a credit card, the interest rate only applies to the money you borrow.

How do you pay back a line of credit?

You will receive a monthly statement that details your advances, payments, interest, and fees, much like with a credit card. A minimum payment is always required, and it can be as much as the total amount owed on the account. Additionally, you might have to pay off the entire balance once a year in order to “clear” the account.

How do you qualify for a line of credit?

In order to be approved, you must have a credit score in the upper-good range (700 or higher) and a track record of on-time debt payments. An unsecured personal line of credit is approved by the bank based on the borrower’s capacity to repay the debt, just like a personal loan or credit card.

Read More :

https://www.investopedia.com/articles/personal-finance/072913/basics-lines-credit.asp

https://www.investopedia.com/terms/l/lineofcredit.asp