There isn’t a universally applicable amount of credit cards that a person should possess. Still, it’s usually a good idea to have multiple active credit card accounts in addition to other credit accounts like mortgages, auto loans, and student loans.

Just keep in mind that how you use your credit cards matters more than how many you have. Before you consider applying for a new credit card, make sure you can afford your current monthly payments.

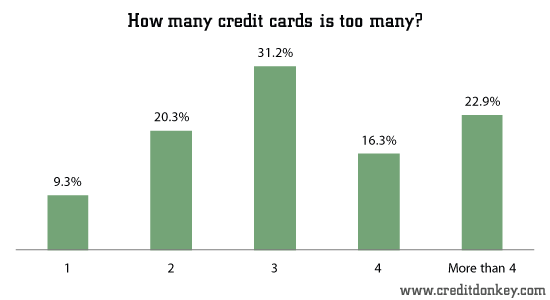

How many credit cards is too many or too few?

Having too few credit accounts is possible, but having too many won’t hurt your credit score. Five or more accounts, which can include a combination of loans and credit cards, are recommended by credit bureaus as a reasonable goal to work toward over time.

It may be difficult for scoring models to generate a score for you if you have a small number of accounts. An account with four or fewer is typically referred to as a “thin file.” A thin file is more difficult to score highly than a fatter one, and thin files may also be seen as riskier by lenders.

Additionally, if you have a thin file rather than more accounts, your credit actions may have a greater impact on your scores. As an illustration, consider how little money you need to spend on a few cards to use up most of your credit limit. The amount of credit that you use is known as credit utilization, and individuals with the highest scores typically use less credit than the 2010% of their limits. Anything that falls below 30% of your limits will usually put you in a good position. More cards may help you with keeping credit utilization low.

However, if managing multiple credit cards becomes overwhelming and you fail to make a payment, it can seriously harm your credit score. Verify your ability to remember deadlines.

How many credit cards should I have?

The sweet spot for you as a person is determined by your spending patterns and your capacity to pay all of your bills on schedule.

Americans on average have three credit cards and 2. 3 retail (store) cards, per an Experian report from 2021. Most people gradually increase their credit portfolio as their needs for credit grow and they get older.

But it’s crucial to remember that in order to apply for a credit card, you must be at least 18 years old. If you’re younger than 21, it could be challenging to get approved.

When you first get credit, it’s a good idea to concentrate on developing sound money management practices. A steady income is just one component of the puzzle. Important traits include being well-organized, having a firm grasp of money management, and being able to meet deadlines.

Potential issues with having multiple credit cards

Having several credit cards has advantages, but there may be drawbacks as well that should be taken into account.

Spacing out credit card applications

Every credit application results in a hard inquiry, which can lower your scores by a few points. The effect is small and fairly short-lived. But applying for a lot of credit cards at once might be seen as a sign of credit risk, and all those hard inquiries mount up. You can avoid having multiple hard inquiries negatively impact your credit score by space out your credit applications by roughly six months.

Managing multiple billing cycles

It may seem apparent, but the more credit cards you have, the more credit limits and due dates you have to remember. To ensure that you remember to pay off your balance in full, one way to ensure that you remember is to automate monthly payments or to synchronize your due dates with paydays. Additionally, you can use NerdWallet to create a free credit score dashboard and monitor your spending, credit utilization, and other details.

Timing credit applications with big future purchases

Time your credit applications if you intend to make a large purchase, such as a new home, in order to preserve your credit scores. Your credit score may suffer if you apply for just one credit card, but the points will come back in around six months. Remember this deadline and postpone applying for credit cards.

Potential impact of multiple credit cards on your credit scores

If you’re considering getting a credit card, here are some things to consider:

Your credit utilization

Approximately one-third of your credit scores are determined by your credit utilization ratio, which is the percentage of your credit limit that you are currently using. Generally speaking, maintaining your balances below 200% of your credit limit will help you maximize your scores, with lower being better.

By raising your total credit limit, obtaining new cards may improve your credit scores. As long as you don’t increase your spending and raise your balances, that will lower your credit utilization.

Your payment history

Your payment history accounts for roughly 2035 percent to 2040 percent of your credit scores, making it the primary factor influencing your scores. Thus, timely payments are far more crucial than the number of cards you own.

Your credit age

Creditors like to see a long, stable credit history. It’s not enough to have one really old card, though. Your credit scores take into account the average age of all of your credit cards.

That doesnt mean you can never close a card. If your justification is strong (such as exorbitant costs or subpar service), it might be worthwhile to temporarily lower your score. Instead of canceling your credit card, you can request to have it changed to a no-fee version if you have multiple cards from the same issuer. This usually allows you to maintain your credit line, meaning it has no effect on your total credit utilization.

Choosing between cards? Rewards and perks might make the difference

When considering obtaining a credit card, it’s a good idea to consider your spending habits. Numerous credit cards come with specific rewards or other advantages that you can add to your everyday purchases. If you enjoy collecting reward points, you should look into the best credit cards that offer cash back or maximize your spending on groceries, travel, and gas.

If you want to keep things simple, thats fine too. Regardless of how many credit cards you have, pay attention to your credit practices. Credit scores are significantly impacted by timely payments and responsible use of credit limits.

FAQ

Is 7 credit cards too many?

Having seven credit cards is acceptable as long as you can manage them properly, which includes making on-time monthly bill payments and maintaining a low credit utilization rate. But according to Experian, the average American only carries about 4 credit cards, so having 7 is unusual and could be challenging to manage.

Is 20 credit cards too much?

Therefore, even though there isn’t a set amount of cards that are too many, it’s advisable to apply for and keep the cards that you really need and can justify using given your credit score, capacity to pay off debt, and desire for rewards.

Is it too much to have 10 credit cards?

There’s no ideal quantity of credit cards to possess, and having several allows you to take advantage of the various rewards programs that each card offers. Your credit utilization ratio would go down and your total line of credit would increase if you had five cards. It’s not too many cards for you if you can handle five at once.

Is it OK to have 5 credit cards?

Key takeaways: While there isn’t a magic number of credit cards you should own, having fewer than five credit accounts in total can hinder your credit score development and deter lenders from offering you loans.

Read More :

https://www.nerdwallet.com/article/finance/how-many-credit-cards

https://www.bankrate.com/finance/credit-cards/how-many-credit-cards-is-too-many/