Reviewed by Editorial Note: Forbes Advisor partner links provide us with a commission. Commissions do not affect our editors opinions or evaluations.

We use our credit cards on a daily basis, but most of us don’t know much about the goals and history they stand for. Have you ever wondered what all those numbers you can never quite remember are really supposed to mean?

What Do All the Numbers on Your Credit Cards Mean?

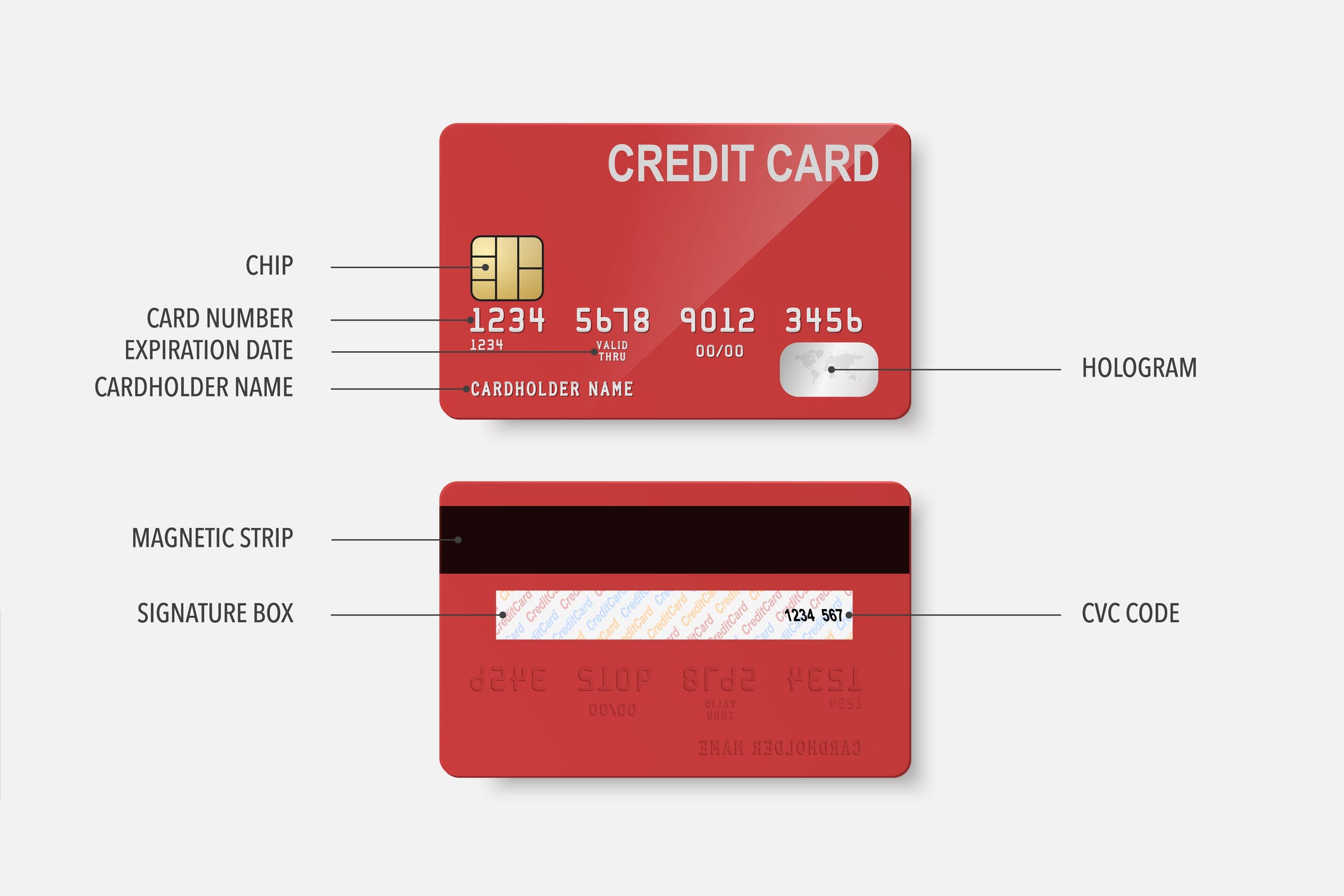

Even though the numbers on your credit card might seem random, they have a purpose. Your credit card is always a part of the American Express, Diners Club, or Carte Blanche payment networks, for instance, if its number starts with 3. The card is a Visa if the number on it starts with a 4. Card numbers starting with 5 are associated with MasterCards, and card numbers starting with 6 are associated with the Discover network.

The card issuer, such as a bank or credit union, and the particular credit card product you are using can be identified by the next five digits. For instance, the first four digits of every Chase Visa Signature card are 414720.

The remaining 15 or 16 digits are distinct and correspond to the account number of the cardholder. These last one or two numbers are “check digits. Check digits are used in a formula to help ascertain whether your credit card number is legitimate. A computer can quickly ascertain the validity of any credit card number using this formula.

Credit Card Numbers Versus Account Numbers

It’s interesting to note that, despite being linked, the number on your credit card isn’t your account number. When making payments, you’ll need to refer to your credit card statement, which will frequently have your account number on it. Your account number will not change in the event that your card is lost or stolen; instead, you will receive a new card with a new credit card number. Additionally, each American Express card has a unique number, even the ones issued to authorized users under the same account. Conversely, when linked to the same account, authorized user cards from different payment networks will have identical numbers.

What About Those Other Numbers?

Another three-digit number is also present on credit cards, and it is typically found in the signature panel on the back of the card. These numbers are also known by other names in addition to CVC numbers (Card Verification Code). When making a purchase over the phone or online, for example, when the card isn’t present, they serve as an additional layer of verification. The front of American Express cards also has a four-digit number known as a CVV (Card Verification Value) that has the same function.

How to Protect Your Credit Card Numbers

Now that you are aware of the significance of each number, you must determine the best way to safeguard them. First of all, you should never take a picture of your credit card number without exercising caution. Even if the credit card isn’t very large in the photo, someone could enlarge it to read the number thanks to the high resolution of modern still and video cameras. Make sure to hide as many of the credit card’s numbers as you can if you must include it in an image. As the initial six numbers are not specific to your card, make sure to conceal the next nine to ten, if not all, of the numbers.

Along with not writing down your credit card numbers, you should also avoid doing so because, like credit card numbers themselves, they could be used fraudulently. Additionally, make sure to notify your card issuer if your credit card is lost or stolen. If you request one, almost all card issuers will send you a replacement card without charging you anything, and many will even send it overnight for free.

Now you know what those long credit card numbers mean. The following action is to safeguard your card numbers and cards to prevent this information from getting into the wrong hands.

Apply for credit cards with assurance and receive tailored offers according to your credit history. Get started with your FICO® Score for free.

FAQ

Are all credit cards 16 digits?

Typically, credit card numbers consist of 16 numbers that are placed in groups of four. American Express numbers contain 15 digits. Though rare, some credit card companies employ 19 digits.

Is there a 12 digit credit card number?

The unique account number associated with a card is indicated by the seventh and all subsequent digits, excluding the last one. There could be nine or twelve digits in your account number.

Do all credit cards have 15 digits?

The number of digits in a credit card can vary from 15 to 19, contingent upon the card issuer. Typically, credit card numbers are 16 digits long.

Can a credit card have 11 digits?

The International Organization for Standardization, also known as ISO, and the American National Standards Institute are the organizations that assign credit card numbers. Your card issuer assigns you an account number, which can have up to sixteen digits. Some cards have only seven digits.

Read More :

https://www.experian.com/blogs/ask-experian/how-many-numbers-are-on-a-credit-card/

https://www.bankrate.com/finance/credit-cards/what-do-the-numbers-on-your-credit-card-mean/