To determine how much interest you will be charged, use the procedures listed below. Please be aware that in order to find the necessary information, it is best to have your billing statement handy.

What goes into the credit card interest calculation

A few variables affect the amount of interest you pay on a credit card:

Grace period

First, let’s talk about the grace period. During this time, you will never have to pay interest on purchases made with your credit card if you pay it in full by the due date each month. Period. Since there is nothing to calculate, a credit card interest calculator isn’t really necessary. Your interest rate can be essentially irrelevant.

However, interest will be charged if you carry over debt from one statement to the next.

Average daily balance

Your credit card statement displays your entire balance as of the last day of the billing period when it arrives in the mail or is posted online. However, the amount utilized to determine your interest charge is not that balance. Your average daily balance for the billing period is the figure that counts. The card issuer totals the balance on your account for each day of the period, divides that total by the total number of days in the period, and then applies the change to your account.

Let’s take an example where you had a $100 balance at the beginning of a 30-day statement cycle:

- For the entire cycle, if you made no charges or payments, your average daily balance would be $100.

- Your average daily balance would be $130 if there was no other activity and a $45 charge post on the eleventh day of the cycle. (Ten days at $100, then 20 days at $145. ).

- Your average daily balance would be $110 if you had a $45 charge on the eleventh day of the cycle and a $60 payment on the twenty-first day. That equates to ten days at $100, ten days at $145, and ten days at $85 ).

- See the math here.

Of course, if you only make one purchase and one payment each month, keeping track of your daily balance is simple. However, it becomes much more difficult if you use your credit card frequently throughout the month. Calculating your average daily balance for the full cycle is a nightmare. To find your average daily balance, we’ve developed a tool that lets you input your purchases and payments made over the course of a month:

The credit card interest calculator on NerdWallet requests that you input your account balance. The most accurate result will be obtained by using your average daily balance. You can estimate how much your account balance is on a typical day, or you can use the closing balance that appears on your statement as a rough estimate.

LOOKING TO SAVE ON INTEREST?If youve got a big purchase coming up, look for a card with a introductory 0% APR period. For existing debt, look into a balance transfer credit card. |

|

|

0% APR credit cards give you a year or more before interest kicks in. Many also come with sign-up bonuses and cash-back rewards, which can translate into a substantial discount on a major purchase. |

Balance transfer credit cards let you move debt from a high-interest card to one with a 0% introductory rate, giving you breathing room to pay it off more quickly at lower cost. |

|

Example: Wells Fargo Active Cash® Card NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.Apply NowRead ReviewRates & Fees |

Example: U.S. Bank Visa® Platinum Card NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.Apply NowRead ReviewRates & Fees |

|

|

|

See more 0% APR credit cards |

See more balance transfer credit cards |

Interest rate

Your monthly statement will include a printed version of the interest rate that applies to purchases made on your account. An annual percentage rate, or APR, is used to express interest rates. Credit cards usually charge interest daily, even though the stated rate is an annual rate. The daily rate is usually 1/365th of the annual rate. So if your APR is, say, 18. 99%, the daily rate would be about 0. 052%, which is 1/365th of 18. 99%.

Interest on credit cards typically compounds daily. That is to say, the interest charged on the first day of the period is added to the computation for the second day, and the same for the third and subsequent days.

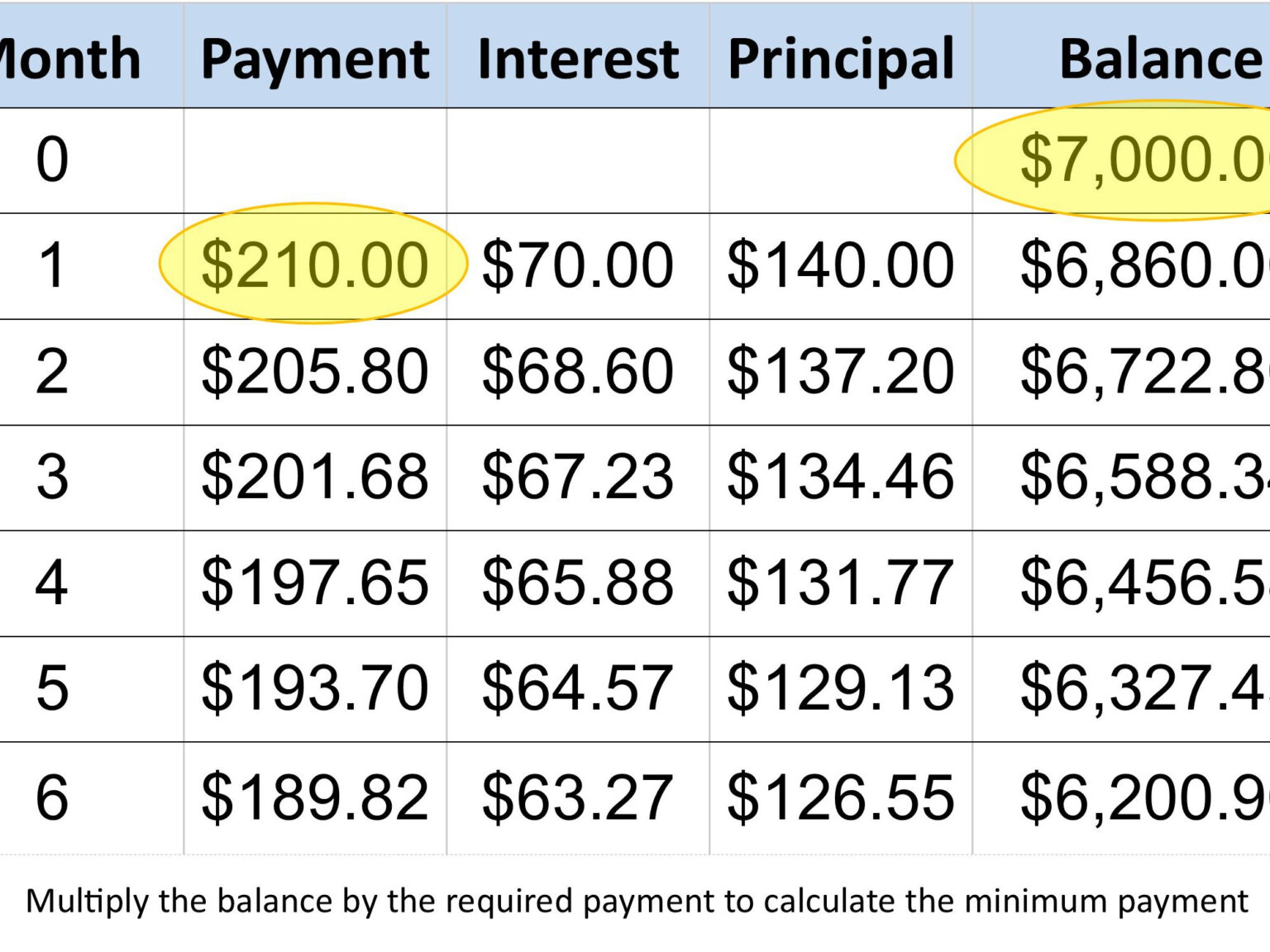

The entire amount of interest that has accumulated, any fees you have paid, and a small portion of the principal balance are typically included in your minimum payment each month.

Many credit cards charge different APRs on different balances. Purchases made with the card are subject to the purchase APR; cash advances and balance transfers are subject to different APRs. In such circumstances, the card issuer computes distinct average daily balances for advances, transfers, and purchases, applying the applicable APRs to each.

Days in the cycle

Though billing periods don’t always correspond with calendar months, each credit card billing cycle spans roughly one month. Usually, they begin in one month and conclude in the next Every month, on or around the same day, your billing cycle ends. The billing period lasts for a variable amount of days, typically 28 or 31 days. There are a few reasons for this:

- Different months have different numbers of days.

- On weekends or holidays, some issuers might not permit statements to close.

- According to federal regulations, you must have at least 21 days between the time your statement closes and your due date, and it must fall on the same day of each month.

Using our credit card interest calculator, you can select a duration between 28 and 31 days. If you’re not sure, 30 days is a good starting point. Alternatively, you can use the number of days in the month that the cycle started. (For instance, use 30 because April has 30 days if the cycle started in April and ended in May.) ).

What’s next?

|

How the math works: 30-day cycle, starting balance of $100 |

|---|

|

No purchases or payments (30 days at $100) 30 x $100 = $3,000 Divided by 30 days in cycle: $3,000 / 30 = $100 |

|

$45 purchase on day 11 (10 days at $100, then 20 days at $145) (10 x $100) + (20 x $145) = $1,000 + $2,900 = $3,900 Divided by 30 days in cycle: $3,900 / 30 = $130 |

|

$45 purchase on day 11 and $60 payment on day 21 (10 days at $100, then 10 days at $145, then 10 days at $85) (10 x $100) + (10 x $145) + (10 x $85) = $1,000 + $1,450 + $850 = $3,300 Divided by 30 days in cycle: $3,300 / 30 = $110 |

Find the right credit card for you.

The best credit cards available allow you to do both—earn more rewards and pay less interest. Simply provide your answers to a few questions, and we’ll focus your search.

FAQ

What is 24% APR on a credit card?

An annual percentage rate, or APR, of 2024 percent means that if you carry a balance on a credit card for the entire year, the amount owed will rise by about 2024 percent because of accrued interest. For example, the interest you would accrue on a $1,000 balance over the course of the year would be about $240. 00.

How do you calculate monthly interest rate?

Interest = Principal × Rate × Tenure is the formula used to calculate interest rates. The interest rate on loans or investments can be found using this formula. What are the benefits of using a loan interest rate calculator? There are various advantages associated with using a loan interest rate calculator.

What does a 20% interest rate on a credit card mean?

During April of 2020, the daily percentage rate is approximately 200. 055%. If a cardholder had a credit card balance of $1,000 and an annual percentage rate of 2020, they would be charged an extra $0. 55 in interest for each day the balance remained unpaid. Other fees that your credit card company might impose are not included in this.

Read More :

https://www.nerdwallet.com/article/credit-cards/credit-card-interest-calculator

https://www.usbank.com/customer-service/knowledge-base/KB0194384.html